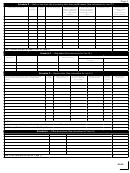

Land values or costs must not be included in this schedule, and

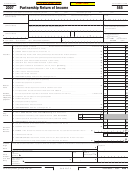

Line 28 Ordinary Income (or Loss) — Subtract Line 27 from Line

where land and buildings were purchased for a lump sum, the

26 and print the amount on Line 28.

cost of the building subject to depreciation must be established.

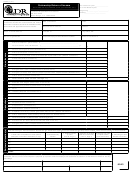

Partners’ Allocations — This schedule should show complete

The total amount of depreciation allowed on each property in

information with respect to all the persons who were members of the

prior years must be shown, and if the cost of any asset has been

partnership, syndicate, group, etc., during any portion of the taxable year.

fully recovered through previous depreciation allowances, the

Although the partnership is not subject to income tax, the members

cost of such assets must not be included in the cost shown in

thereof are liable for income tax in their separate capacities and are

the schedule of depreciable assets. (See R.S. 47:65 and R.S.

taxable upon their distributive shares of the income of the partnership,

47:157.)

whether distributed or not, and each is required to include his share in

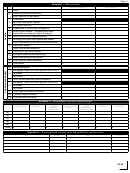

Line 22 Amortization — Print the amount of deduction with respect

his return. However, a partner may not claim on his separate return a

to the amortization of the adjusted basis of any emergency

distributive share of loss from a partnership to the extent any such loss

facility constructed or erected in taxable years beginning after

exceeds the basis of his interest in the partnership. The excess of such

December 31, 1955 (R.S. 47:65 (I)), with respect to which the

loss may be claimed for later years to the extent that the basis for the

Government has issued a certificate of necessity. A statement

partner’s interest is increased above zero. Each partner should be advised

of the pertinent facts should be filed with the return. No

by the partnership of his share of the income, deductions, and credits as

amortization is permitted with respect to the adjusted basis

shown on Schedule J. Individuals should use the information reported

of a grain storage facility or certain expenditures relating

on the federal partnership return instead of the amounts shown in

to research and experiment and trademark and trade name

the partners’ allocation schedule. Corporations should refer to R. S.

expenditures.

47:287.93(A)(5).

Federal Employer Identification Number — Please supply the employer

Line 23 Depletion of Mines, Oil and Gas Wells, Timber, etc. —

identification number assigned to the partnership by the Internal

Print the amount of depletion of mines, oil or gas wells,

Revenue Service. Print this number in the space provided on Form

timber, etc. If complete valuation data has been filed in

IT-565, page 1.

previous years, file with the return the information neces-

sary to bring the depletion schedule up-to-date, setting

Federal Net Income — Print the amount of the partnership’s Federal

forth in full a statement of all the transactions bearing on

net income reported to the Internal Revenue Service on Form IT-565,

the deductions from or additions to the value of physical

page 1. This information is required by R.S. 47:103(B).

assets during the taxable year, with an explanation of how

R.S. 47:103(C) also requires that every taxpayer whose Federal Income

the depletion deduction for the taxable year has been de-

Tax Return is adjusted must furnish a statement disclosing the nature and

termined.

amounts of such adjustments within 60 days after the Federal adjustments

have been made and are accepted by the taxpayer.

Line 24 Other Deductions Authorized by Law — Print the amount

of other authorized deductions for which no space is provided

Signatures

elsewhere on Page 1 of the return, exclusive of items requiring

The return must be signed by any one of the partners or members.

separate computation and required to be reported on Schedule

If receivers, trustees in bankruptcy, or assignees are in control of the

J. Do not deduct losses incurred in transactions that were

property or business of the organization, such receivers, trustees, or

neither connected with the trade or business nor entered into

assignees shall execute the return.

for profit. No deduction is allowed for any expense incurred

Any person(s), firm, or corporation who prepares a taxpayer’s return must

to produce income not subject to Louisiana Income Tax. If an

also sign. If a return is prepared by a firm or corporation, the return must

expense is incurred in part for the production of taxable income

be signed in the name of the firm or corporation. This verification is not

and in part for the production of tax exempt income, then only

required where the return is prepared by a regular, full-time employee

the portion of the expense that can reasonably be attributed

of the taxpayer.

to the production of taxable income is deductible.

A partnership receiving any exempt income, other than

interest, or holding any property or engaging in any activ-

ity the income from which is exempt shall submit with its

return as a part thereof an itemized statement showing

(1) the amount of each class of exempt income; and, (2)

the amount of expense items allocated to each such class

(the amount allocated by apportionment being shown

separately).

Line 25 Total Deductions — Add the amounts on Lines 13 through

24 and print that amount on Line 25.

Line 26 Net Income (or Loss) — Subtract Line 25 from Line 12 and

print that amount on Line 26.

Line 27 Net Gain from Sale of Capital Assets — Print on Line 27

the amount of gain from the sale or exchange of capital assets

found on Line 9.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12