Form K-220 - Kansas Underpayment Of Estimated Corporate Tax - 2011

ADVERTISEMENT

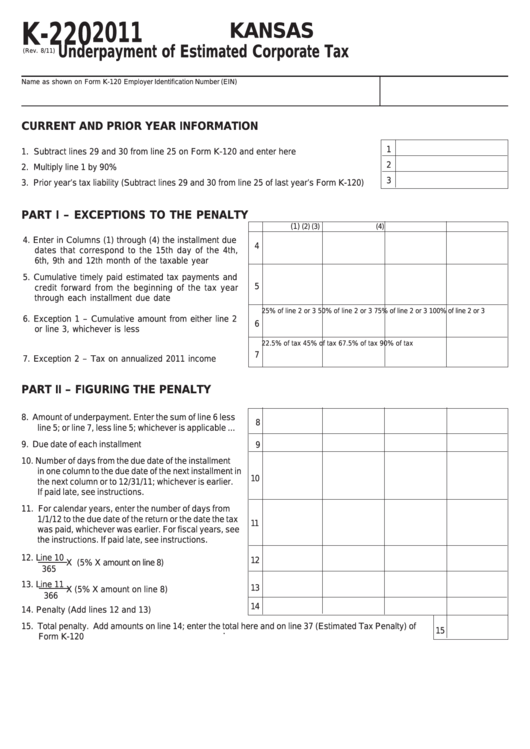

K-220

2011

KANSAS

Underpayment of Estimated Corporate Tax

(Rev. 8/11)

Name as shown on Form K-120

Employer Identification Number (EIN)

CURRENT AND PRIOR YEAR INFORMATION

1

1. Subtract lines 29 and 30 from line 25 on Form K-120 and enter here ................................

2

2. Multiply line 1 by 90% ...........................................................................................................

3

3. Prior year’s tax liability (Subtract lines 29 and 30 from line 25 of last year’s Form K-120) ....

PART I – EXCEPTIONS TO THE PENALTY

(1)

(2)

(3)

(4)

4. Enter in Columns (1) through (4) the installment due

4

dates that correspond to the 15th day of the 4th,

6th, 9th and 12th month of the taxable year .........

5. Cumulative timely paid estimated tax payments and

5

credit forward from the beginning of the tax year

through each installment due date .........................

25% of line 2 or 3

50% of line 2 or 3

75% of line 2 or 3

100% of line 2 or 3

6. Exception 1 – Cumulative amount from either line 2

6

or line 3, whichever is less ......................................

22.5% of tax

45% of tax

67.5% of tax

90% of tax

7

7. Exception 2 – Tax on annualized 2011 income ......

PART II – FIGURING THE PENALTY

8. Amount of underpayment. Enter the sum of line 6 less

8

line 5; or line 7, less line 5; whichever is applicable ...

9. Due date of each installment ....................................

9

10. Number of days from the due date of the installment

in one column to the due date of the next installment in

10

the next column or to 12/31/11; whichever is earlier.

If paid late, see instructions. .....................................

11. For calendar years, enter the number of days from

1/1/12 to the due date of the return or the date the tax

11

was paid, whichever was earlier. For fiscal years, see

the instructions. If paid late, see instructions.

12. Line 10

12

X (5% X amount on line 8)........................

365

13. Line 11

13

X (5% X amount on line 8)........................

366

14

14. Penalty (Add lines 12 and 13) ..................................

15. Total penalty. Add amounts on line 14; enter the total here and on line 37 (Estimated Tax Penalty) of

15

.

Form K-120 ..........................................................................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2