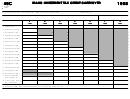

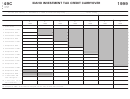

49

2011

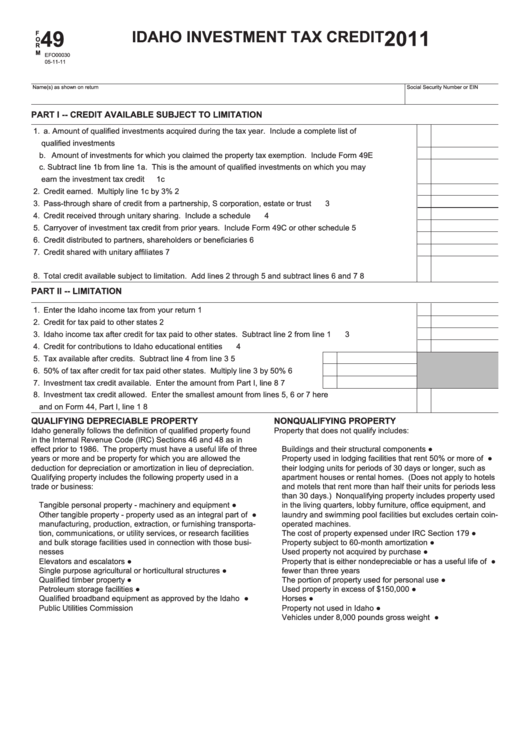

IDAHO INVESTMENT TAX CREDIT

F

O

R

M

EFO00030

05-11-11

Name(s) as shown on return

Social Security Number or EIN

PART I -- CREDIT AVAILABLE SUBJECT TO LIMITATION

1. a. Amount of qualified investments acquired during the tax year. Include a complete list of

qualified investments ...............................................................................................................................

1a

b. Amount of investments for which you claimed the property tax exemption. Include Form 49E .............

1b

c. Subtract line 1b from line 1a. This is the amount of qualified investments on which you may

earn the investment tax credit .................................................................................................................

1c

2. Credit earned. Multiply line 1c by 3% ...........................................................................................................

2

3. Pass-through share of credit from a partnership, S corporation, estate or trust ...........................................

3

4. Credit received through unitary sharing. Include a schedule .......................................................................

4

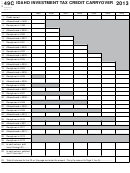

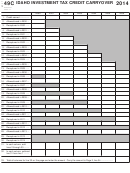

5. Carryover of investment tax credit from prior years. Include Form 49C or other schedule ..........................

5

6. Credit distributed to partners, shareholders or beneficiaries ........................................................................

6

7. Credit shared with unitary affiliates ...............................................................................................................

7

8. Total credit available subject to limitation. Add lines 2 through 5 and subtract lines 6 and 7 .......................

8

PART II -- LIMITATION

1. Enter the Idaho income tax from your return ................................................................................................

1

2. Credit for tax paid to other states ..................................................................................................................

2

3. Idaho income tax after credit for tax paid to other states. Subtract line 2 from line 1 ..................................

3

4. Credit for contributions to Idaho educational entities ....................................................................................

4

5. Tax available after credits. Subtract line 4 from line 3 ........................................

5

6. 50% of tax after credit for tax paid other states. Multiply line 3 by 50% .............

6

7. Investment tax credit available. Enter the amount from Part I, line 8 .................

7

8. Investment tax credit allowed. Enter the smallest amount from lines 5, 6 or 7 here

and on Form 44, Part I, line 1 .......................................................................................................................

8

QUALIFYING DEPRECIABLE PROPERTY

NONQUALIFYING PROPERTY

Idaho generally follows the definition of qualified property found

Property that does not qualify includes:

in the Internal Revenue Code (IRC) Sections 46 and 48 as in

effect prior to 1986. The property must have a useful life of three

●

Buildings and their structural components

years or more and be property for which you are allowed the

●

Property used in lodging facilities that rent 50% or more of

deduction for depreciation or amortization in lieu of depreciation.

their lodging units for periods of 30 days or longer, such as

Qualifying property includes the following property used in a

apartment houses or rental homes. (Does not apply to hotels

trade or business:

and motels that rent more than half their units for periods less

than 30 days.) Nonqualifying property includes property used

●

Tangible personal property - machinery and equipment

in the living quarters, lobby furniture, office equipment, and

●

Other tangible property - property used as an integral part of

laundry and swimming pool facilities but excludes certain coin-

manufacturing, production, extraction, or furnishing transporta-

operated machines.

tion, communications, or utility services, or research facilities

●

The cost of property expensed under IRC Section 179

and bulk storage facilities used in connection with those busi-

●

Property subject to 60-month amortization

nesses

●

Used property not acquired by purchase

●

Elevators and escalators

●

Property that is either nondepreciable or has a useful life of

●

Single purpose agricultural or horticultural structures

fewer than three years

●

Qualified timber property

●

The portion of property used for personal use

●

Petroleum storage facilities

●

Used property in excess of $150,000

●

Qualified broadband equipment as approved by the Idaho

●

Horses

Public Utilities Commission

●

Property not used in Idaho

●

Vehicles under 8,000 pounds gross weight

1

1 2

2