Form St-36 - Kansas Retailers' Sales Tax, Publication Ks-1700 - Kansas Sales Tax Jurisdiction Code Booklet Page 4

ADVERTISEMENT

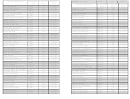

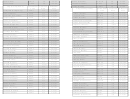

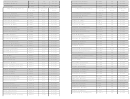

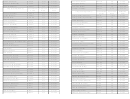

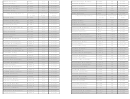

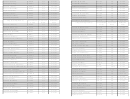

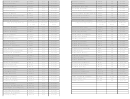

TABLE A ³ Kansas Incorporated Cities

Kansas Sales Tax Jurisdiction Code Booklet

The Jurisdiction Code Booklet will be used only by those customers

C i t y ( C ount y N am e)

Jur i sdi ct i on

Tot al Tax

Ef f ect i ve

reporting Kansas sales tax or use tax for more than one local taxing

C ode

R at e

D at e

jurisdiction. The Kansas retailers’ sales tax or Kansas retailers’ use tax on

Abbyvi l l e ( R eno)

ABBR N

5. 9

6- 1- 92

vehicles and vehicle leases rate is a combination of the state rate of 4.9%

Abi l ene ( D i cki nson)

ABI D K

6. 65

10- 1- 00

plus any local tax percentage levied by a county or a city. Use the

Adm i r e ( Lyon)

AD M LY

5. 4

7- 1- 99

jurisdiction letter codes from this book on these sales and use tax returns:

Agenda ( R epubl i c)

AG ER P

5. 9

6- 1- 92

ST-36, ST-36D, ST-80, CT-4 and CT-114. The codes in Table A are

Agr a ( Phi l l i ps)

AG R PL

4. 9

6- 1- 92

comprised of the first three letters of the city, (if no duplicates), and the last

Al ber t ( Bar t on)

ALBBT

5. 9

6- 1- 92

two letters are for the county in which the city resides (the same letters

Al den ( R i ce)

ALD R C

5. 9

6- 1- 92

used on vehicle tags). The codes in Table B are comprised of the first

Al exander ( R ush)

ALER H

4. 9

6- 1- 92

three letters of the county name followed by the letters “CO”.

Al l en ( Lyon)

ALLLY

5. 4

7- 1- 99

Al m a ( W abaunsee)

ALM W B

6. 15

1- 1- 01

Table A is an alphabetical list of incorporated Kansas cities, the

Al m ena ( N or t on)

ALM N T

4. 9

6- 1- 92

jurisdiction code assigned, the total combined state and/or local sales tax

Al t a Vi st a ( W abaunsee)

ALTW B

6. 15

1- 1- 01

rate to be collected in those cities and the effective date of the latest tax

Al t am ont ( Labet t e)

ALTLB

7. 15

10- 1- 01

rate change (city, county, or state). If your business or point of sale is

Al t on ( O sbor ne)

ALTO B

5. 4

6- 1- 92

located within the city limits of a city listed in Table A, select the

Al t oona ( W i l son)

ALTW L

5. 9

10- 1- 00

appropriate jurisdiction code and tax rate to enter on your return. If your

Am er i cus ( Lyon)

AM ELY

5. 9

7- 1- 99

city is not listed in Table A, or if your business location or point of sale is

Andal e ( Sedgw i ck)

AN D SG

5. 9

6- 1- 92

outside the city limits of a city listed in Table A, use Table B.

Andover ( But l er )

AN D BU

5. 9

1- 1- 01

Ant hony ( H ar per )

AN TH P

6. 4

1- 1- 01

Table B (page 18) is an alphabetical list of the 105 Kansas counties, the

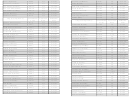

Ar cadi a ( C r aw f or d)

AR C C R

5. 9

7- 1- 01

jurisdiction code for that county, and the combined state and county (where

Ar goni a ( Sum ner )

AR G SU

5. 9

6- 1- 92

applicable) tax rate.

Ar kansas C i t y ( C ow l ey)

AR KC L

5. 9

6- 1- 92

Ar l i ngt on ( R eno)

AR LR N

5. 9

6- 1- 92

Table C (page 21) is a list of the special jurisdiction areas such as a

Ar m a ( C r aw f or d)

AR M C R

6. 4

7- 1- 01

historical theater, racetrack or theme park. Businesses that are located in

these special jurisdiction areas will be notified separately.

Ashl and ( C l ar k)

ASH C A

4. 9

6- 1- 92

Assar i a ( Sal i ne)

ASSSA

5. 9

6- 1- 95

The Jurisdiction Code Booklet will be updated and distributed annually.

At chi son ( At chi nson)

ATC AT

7. 4

7- 1- 98

However throughout the year you will also receive notice of any tax rate

At hol ( Sm i t h)

ATH SM

4. 9

6- 1- 92

changes as well as additional cities imposing a city sales tax (may be

At l ant a ( C ow l ey)

ATLC L

4. 9

6- 1- 92

entered on the blank lines at the end of Table A). Please be sure to include

At t i ca ( H ar per )

ATTH P

4. 9

6- 1- 92

these changes in your booklet for future reference and use until you receive

At w ood ( R aw l i ns)

ATW R A

5. 9

6- 1- 92

an updated code booklet. For updates you may contact our web site at:

Aubur n ( Shaw nee)

AU BSN

6. 8

7- 1- 99

August a ( But l er )

AU G BU

5. 4

6- 1- 92

Aur or a ( C l oud)

AU R C D

5. 9

1- 1- 01

If you have questions about tax rates or how to use these tables contact

Axt el l ( M ar shal l )

AXTM S

4. 9

6- 1- 92

your Customer Representative or call toll free 877-526-7738.

Bal dw i n C i t y ( D ougl as)

BALD G

6. 9

1- 1- 95

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14