Form C-107 - Tax Tables For Succession And Transfer Taxes

ADVERTISEMENT

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT 06106-5032

(Rev. 09/05)

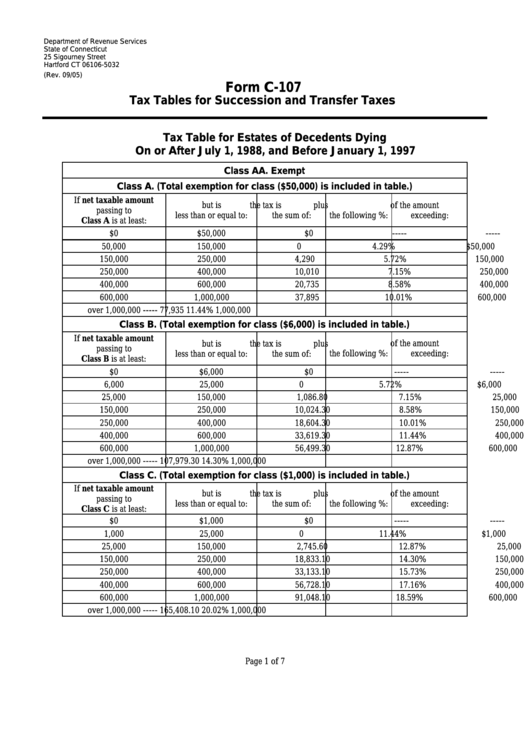

Form C-107

Tax Tables for Succession and Transfer Taxes

Tax Table for Estates of Decedents Dying

On or After July 1, 1988, and Before January 1, 1997

Class AA. Exempt

Class A. (Total exemption for class ($50,000) is included in table.)

If net taxable amount

but is

the tax is

plus

of the amount

passing to

the following %:

exceeding:

less than or equal to:

the sum of:

Class A is at least:

$0

$50,000

$0

-----

-----

50,000

150,000

0

4.29%

$50,000

150,000

250,000

4,290

5.72%

150,000

250,000

400,000

10,010

7.15%

250,000

400,000

600,000

20,735

8.58%

400,000

600,000

1,000,000

37,895

10.01%

600,000

over 1,000,000

-----

77,935

11.44%

1,000,000

Class B. (Total exemption for class ($6,000) is included in table.)

If net taxable amount

but is

the tax is

plus

of the amount

passing to

the following %:

exceeding:

less than or equal to:

the sum of:

Class B is at least:

$0

$6,000

$0

-----

-----

6,000

25,000

0

5.72%

$6,000

25,000

150,000

1,086.80

7.15%

25,000

150,000

250,000

10,024.30

8.58%

150,000

250,000

400,000

18,604.30

10.01%

250,000

400,000

600,000

33,619.30

11.44%

400,000

600,000

1,000,000

56,499.30

12.87%

600,000

over 1,000,000

-----

107,979.30

14.30%

1,000,000

Class C. (Total exemption for class ($1,000) is included in table.)

If net taxable amount

but is

the tax is

plus

of the amount

passing to

less than or equal to:

the sum of:

the following %:

exceeding:

Class C is at least:

$0

$1,000

$0

-----

-----

1,000

25,000

0

11.44%

$1,000

25,000

150,000

2,745.60

12.87%

25,000

150,000

250,000

18,833.10

14.30%

150,000

250,000

400,000

33,133.10

15.73%

250,000

400,000

600,000

56,728.10

17.16%

400,000

600,000

1,000,000

91,048.10

18.59%

600,000

over 1,000,000

-----

165,408.10

20.02%

1,000,000

Page 1 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7