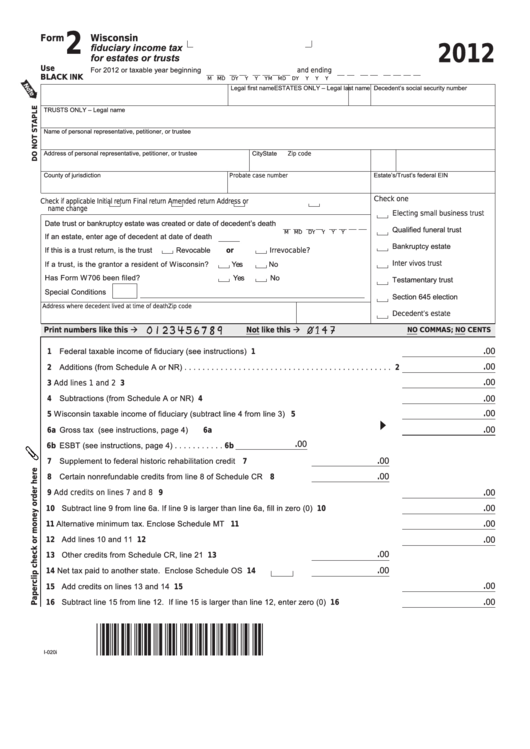

2

Form

Wisconsin

fiduciary income tax

2012

for estates or trusts

Use

For 2012 or taxable year beginning

and ending

BLACK INK

M M

D

D

Y

Y

Y

Y

M M

D

D

Y

Y

Y

Y

ESTATES ONLY – Legal last name

Legal first name

M.I.

Decedent’s social security number

TRUSTS ONLY – Legal name

Name of personal representative, petitioner, or trustee

Address of personal representative, petitioner, or trustee

City

State

Zip code

County of jurisdiction

Estate’s/ Trust’s federal EIN

Probate case number

Check one

Check if applicable

Initial return

Final return

Amended return

Address or

name change

Electing small business trust

Date trust or bankruptcy estate was created or date of decedent’s death

Qualified funeral trust

M M

D

D

Y

Y

Y

Y

If an estate, enter age of decedent at date of death

Bankruptcy estate

If this is a trust return, is the trust

Revocable

or

Irrevocable?

If a trust, is the grantor a resident of Wisconsin?

Yes

No

Inter vivos trust

Has Form W706 been filed? . . . . . . . . . . . . . . .

Yes

No

Testamentary trust

Special Conditions

Section 645 election

Address where decedent lived at time of death

Zip code

Decedent’s estate

Print numbers like this

Not like this

NO COMMAS; NO CENTS

1 Federal taxable income of fiduciary (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.00

2 Additions (from Schedule A or NR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.00

.00

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Subtractions (from Schedule A or NR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

.00

5 Wisconsin taxable income of fiduciary (subtract line 4 from line 3) . . . . . . . . . . . . . . . . . . . . . 5

.00

6a Gross tax (see instructions, page 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

6a

6b ESBT (see instructions, page 4) . . . . . . . . . . . 6b

.00

7 Supplement to federal historic rehabilitation credit . . . . . . . . . . . . . .

.00

7

8 Certain nonrefundable credits from line 8 of Schedule CR . . . . . . . .

.00

8

.00

9 Add credits on lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Subtract line 9 from line 6a. If line 9 is larger than line 6a, fill in zero (0) . . . . . . . . . . . . . . . . . 10

.00

11 Alternative minimum tax. Enclose Schedule MT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.00

12 Add lines 10 and 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

.00

13 Other credits from Schedule CR, line 21 . . . . . . . . . . . . . . . . . . . . . 13

.00

14 Net tax paid to another state. Enclose Schedule OS . . . .

.00

14

15 Add credits on lines 13 and 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

.00

16 Subtract line 15 from line 12. If line 15 is larger than line 12, enter zero (0) . . . . . . . . . . . . . . 16

.00

I-020i

1

1 2

2 3

3