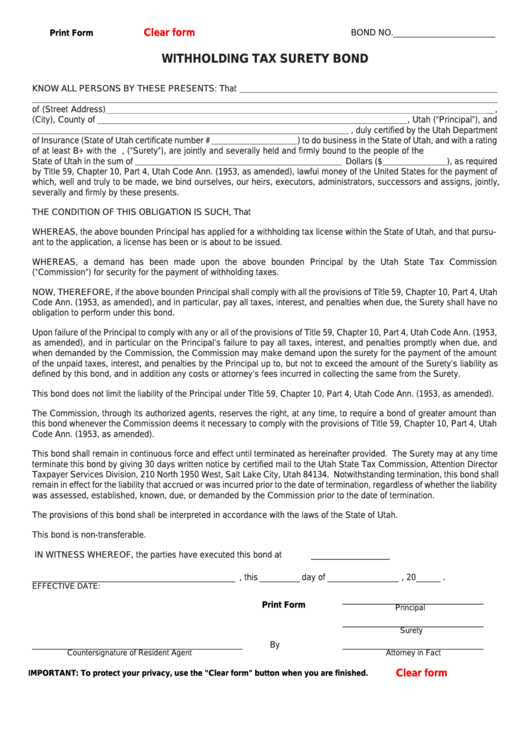

Clear form

Print Form

BOND NO.__ _ __ _ __ _ __ _ _

TC-763WT.ai Rev. 10/05

WITHHOLDING TAX SURETY BOND

KNOW ALL PERSONS BY THESE PRESENTS: That

___ ___ _ __ _ __ _ __ _ __ _ __ _ __ _ __ _ __ _ _

__________________________________________________________

of (Street

Address)______ ___ ___ ___ ___ ___ ___ _ __ _ __ _ __ _ __ _ __ _ __ _ __ _ __ _

,

(City), County of

_______ ___ __ ___ _ ___ __ ____ _ __ _ __ _ __ _ __ _ _

, Utah (“Principal”), and

______________ ____ __ ___ ___ ___ __ __ __ _ __ _ _

, duly certified by the Utah Department

of Insurance (State of Utah certificate number

#__ ___ ___ ___

) to do business in the State of Utah, and with a rating

of at least B+ with the A.M. Best Company, (“Surety”), are jointly and severally held and firmly bound to the people of the

State of Utah in the sum of

__ ___ ___ ___ ___ __ ___ __ _ _ __ _

Dollars

($_ _ __ _ __ _

), as required

by Title 59, Chapter 10, Part 4, Utah Code Ann. (1953, as amended), lawful money of the United States for the payment of

which, well and truly to be made, we bind ourselves, our heirs, executors, administrators, successors and assigns, jointly,

severally and firmly by these presents.

THE CONDITION OF THIS OBLIGATION IS SUCH, That

WHEREAS, the above bounden Principal has applied for a withholding tax license within the State of Utah, and that pursu-

ant to the application, a license has been or is about to be issued.

WHEREAS, a demand has been made upon the above bounden Principal by the Utah State Tax Commission

(“Commission”) for security for the payment of withholding taxes.

NOW, THEREFORE, if the above bounden Principal shall comply with all the provisions of Title 59, Chapter 10, Part 4, Utah

Code Ann. (1953, as amended), and in particular, pay all taxes, interest, and penalties when due, the Surety shall have no

obligation to perform under this bond.

Upon failure of the Principal to comply with any or all of the provisions of Title 59, Chapter 10, Part 4, Utah Code Ann. (1953,

as amended), and in particular on the Principal’s failure to pay all taxes, interest, and penalties promptly when due, and

when demanded by the Commission, the Commission may make demand upon the surety for the payment of the amount

of the unpaid taxes, interest, and penalties by the Principal up to, but not to exceed the amount of the Surety’s liability as

defined by this bond, and in addition any costs or attorney’s fees incurred in collecting the same from the Surety.

This bond does not limit the liability of the Principal under Title 59, Chapter 10, Part 4, Utah Code Ann. (1953, as amended).

The Commission, through its authorized agents, reserves the right, at any time, to require a bond of greater amount than

this bond whenever the Commission deems it necessary to comply with the provisions of Title 59, Chapter 10, Part 4, Utah

Code Ann. (1953, as amended).

This bond shall remain in continuous force and effect until terminated as hereinafter provided. The Surety may at any time

terminate this bond by giving 30 days written notice by certified mail to the Utah State Tax Commission, Attention Director

Taxpayer Services Division, 210 North 1950 West, Salt Lake City, Utah 84134. Notwithstanding termination, this bond shall

remain in effect for the liability that accrued or was incurred prior to the date of termination, regardless of whether the liability

was assessed, established, known, due, or demanded by the Commission prior to the date of termination.

The provisions of this bond shall be interpreted in accordance with the laws of the State of Utah.

This bond is non-transferable.

IN WITNESS WHEREOF, the parties have executed this bond at _ _ __ _ __ _ __

_____ ___________ ___ ___ __ __ , this _____ day of __ _ _ __ _ __ , 20_ _ _ .

EFFECTIVE DATE:

By _ _ __ _ __ _ __ _ __ _ __ _ _

Print Form

Principal

_ _ __ _ __ _ __ _ __ _ __ _ _

Surety

_____ ________ _______________________

By _ _ __ _ __ _ __ _ __ _ __ _ _

Countersignature of Resident Agent

Attorney in Fact

Clear form

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

1

1 2

2