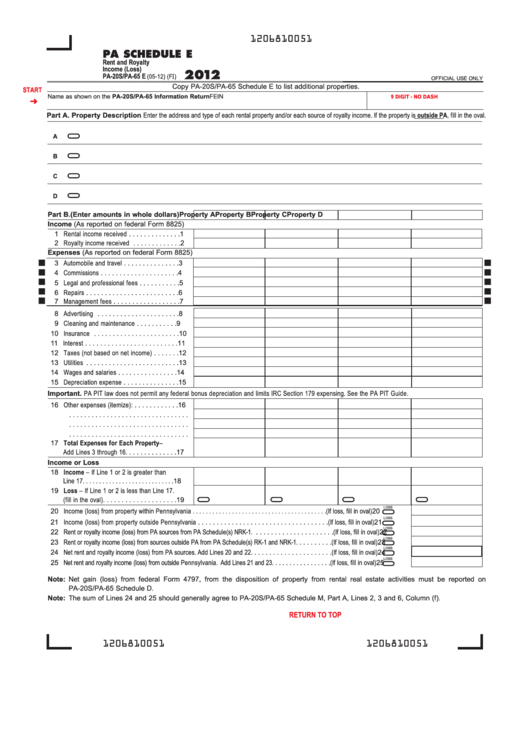

1206810051

PA SCHEDULE E

Rent and Royalty

Income (Loss)

2012

PA-20S/PA-65 E

(05-12) (FI)

OFFICIAL USE ONLY

Copy PA-20S/PA-65 Schedule E to list additional properties.

START

Name as shown on the PA-20S/PA-65 Information Return

FEIN

9 DIGIT - NO DASH

Part A. Property Description Enter the address and type of each rental property and/or each source of royalty income. If the property is outside PA, fill in the oval.

A

B

C

D

Part B. (Enter amounts in whole dollars)

Property A

Property B

Property C

Property D

Income (As reported on federal Form 8825)

1 Rental income received . . . . . . . . . . . . . . 1

2 Royalty income received . . . . . . . . . . . . . 2

Expenses (As reported on federal Form 8825)

¢

¢

3 Automobile and travel . . . . . . . . . . . . . . . 3

¢

¢

4 Commissions . . . . . . . . . . . . . . . . . . . . . 4

¢

¢

5 Legal and professional fees . . . . . . . . . . . 5

¢

¢

6 Repairs . . . . . . . . . . . . . . . . . . . . . . . . . 6

¢

¢

7 Management fees . . . . . . . . . . . . . . . . . . 7

8 Advertising . . . . . . . . . . . . . . . . . . . . . . 8

9 Cleaning and maintenance . . . . . . . . . . . 9

10 Insurance . . . . . . . . . . . . . . . . . . . . . . .10

11 Interest . . . . . . . . . . . . . . . . . . . . . . . . .11

12 Taxes (not based on net income) . . . . . . .12

13 Utilities . . . . . . . . . . . . . . . . . . . . . . . . .13

14 Wages and salaries . . . . . . . . . . . . . . . .14

15 Depreciation expense . . . . . . . . . . . . . . .15

Important. PA PIT law does not permit any federal bonus depreciation and limits IRC Section 179 expensing. See the PA PIT Guide.

16 Other expenses (itemize): . . . . . . . . . . . .16

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 Total Expenses for Each Property –

Add Lines 3 through 16. . . . . . . . . . . . . .17

Income or Loss

18 Income – If Line 1 or 2 is greater than

Line 17. . . . . . . . . . . . . . . . . . . . . . . . . . . .18

19 Loss – If Line 1 or 2 is less than Line 17.

(fill in the oval). . . . . . . . . . . . . . . . . . . .19

LOSS

20 Income (loss) from property within Pennsylvania . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(If loss, fill in oval)

20

LOSS

21 Income (loss) from property outside Pennsylvania . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(If loss, fill in oval)

21

LOSS

22 Rent or royalty income (loss) from PA sources from PA Schedule(s) NRK-1. . . . . . . . . . . . . . . . . . . . . .(If loss, fill in oval)

22

LOSS

23 Rent or royalty income (loss) from sources outside PA from PA Schedule(s) RK-1 and NRK-1. . . . . . . . . .(If loss, fill in oval)

23

LOSS

24 Net rent and royalty income (loss) from PA sources. Add Lines 20 and 22. . . . . . . . . . . . . . . . . . . . . .(If loss, fill in oval)

24

LOSS

25 Net rent and royalty income (loss) from outside Pennsylvania. Add Lines 21 and 23. . . . . . . . . . . . . . . . .(If loss, fill in oval)

25

Note: Net gain (loss) from federal Form 4797, from the disposition of property from rental real estate activities must be reported on

PA-20S/PA-65 Schedule D.

Note: The sum of Lines 24 and 25 should generally agree to PA-20S/PA-65 Schedule M, Part A, Lines 2, 3 and 6, Column (f).

PRINT FORM

Reset Entire Form

RETURN TO TOP

1206810051

1206810051

1

1