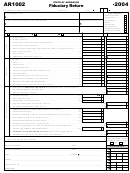

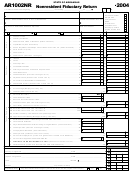

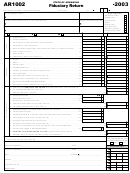

Form Ar1002 - Fiduciary Return - State Of Arkansas - 2003 Page 2

ADVERTISEMENT

Schedule A: Capital Gains Worksheet (Attach Federal Schedule D, Form 1041)

Arkansas has not adopted the depreciation provisions contained in the Job Creation Workers Act of 2002 and the Jobs and Growth Tax Relief Reconciliation

Act of 2003. While the new depreciation provisions may be used for federal returns, Arkansas operates under a different tax code. On Arkansas income

tax returns, taxpayers must file following the rules in sections 167, 168, 179, and 179A under the Internal Revenue Code of 1986, enacted January 1,

1999. Arkansas does not recognize the 50% bonus depreciation or the increased Section 179 expense provisions, therefore there may be differences in

the Arkansas and the federal basis of assets that you dispose of during the year. These differences should be reconciled using the adjustment lines in the

worksheet below.

You can find more information about Arkansas tax code, or file your income tax electronically, by visiting the Department of Finance and Administration

web site at .

Complete this worksheet only if you have a NET CAPITAL GAIN OR LOSS reported on Schedule D, Federal Form 1041, Line 13. Adjust your gains and

losses for any federal and Arkansas differences in depreciation treatment. Arkansas has not adopted federal bonus depreciation or the increased Internal

Revenue Code §179 provisions.

Per Sch D, Form 1041

Arkansas

1.

Enter Federal Long-Term Capital Gain or Loss reported on Line 13,

00

00

Schedule D, Form 1041. .......................................................................................................... 1

2.

Enter adjustment, if any, for federal/state depreciation

00

differences. .......................................................................................................................................................................... 2

00

3.

Arkansas Long-Term Capital Gain or Loss, add (or subtract) Line 1 and Line 2. ........................................................... 3

4.

Enter Federal Net Short-Term Capital Loss, if any, reported

00

00

on Line 5b, Schedule D, Form 1041. ...................................................................................... 4

5.

Enter adjustment, if any, for federal/state depreciation

00

differences. .......................................................................................................................................................................... 5

00

6.

Arkansas Net Short-Term Capital Loss, add (or subtract) Line 4 and Line 5. ................................................................. 6

00

7.

Arkansas Net Capital Gain or Loss (If gain, subtract Line 6 from 3. If loss add Lines 6 and 3) .................................... 7

00

8.

Arkansas Taxable Amount. If a gain, multiply Line 7 by 70 percent (.70), otherwise enter loss. ................................... 8

9.

Enter Federal Short-Term Capital Gain, if any, reported on

00

00

Line 5b, Schedule D, Form 1041. ........................................................................................... 9

10.

Enter adjustment, if any, for federal/state depreciation

00

differences. ........................................................................................................................................................................ 10

00

11.

Arkansas Short-Term Capital Gain, add (or subtract) Line 9 and Line 10. .................................................................... 11

12.

Total taxable Arkansas Capital Gain or Loss, add Lines 8 and 11, enter here

00

and on Line 4, Form AR1002/AR1002NR. ....................................................................................................................... 12

Schedule B: Income Distribution (Attach Federal K-1’s)

Beneficiaries’ share of income: ____________________________

Number of beneficiaries that received a distribution: _____________

FIRST NAME

MI

LAST NAME

SSN

ADDRESS

ST

ZIP

AMOUNT

00

00

00

00

00

00

00

00

00

00

Mail TAX DUE to: State Income Tax, P. O. Box 2144, Little Rock, AR 72203-2144

Mail AMENDED to:

State Income Tax, P. O. Box 3628, Little Rock, AR 72203-3628

Mail REFUND to: State Income Tax, P. O. Box 1000, Little Rock, AR 72203-1000

Mail NO TAX DUE to: State Income Tax, P. O. Box 8026, Little Rock, AR 72203-8026

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2