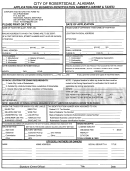

Application For Business Tax And License And Report To County Clerk As Required By Section 67-4-715 Tennessee Code Annotated - 2008 Page 8

ADVERTISEMENT

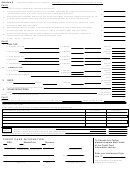

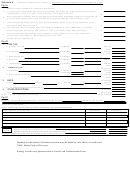

Schedule A

Deductions for Business Tax Purposes

Deductions must have adequate records of support to qualify.

Part A

1.

Sales of services substantially performed in other States

1

2.

The proceeds of the sale of goods, wares, or merchandise returned by the customer when the sales price is

refunded either in cash or in credit. Line E, Schedule A, State Sales Tax Return

2

Bona Fide Sales in Interstate Commerce where the purchaser takes possession outside of Tennessee for use

3.

or consumption outside of Tennessee and item is actually delivered by the seller of common carrier.

3

4.

Cash discounts allowed and taken on sales; Amounts allowed at trade-in value for any article sold. Line C,

Schedule A, State Sales Tax Return

4

5.

Repossessions--Enter that portion of the unpaid principal balances in exess of $500.00 due on tangible

personal properties repossessed from customers. (Line H, Schedule A, State Sales Tax Return.)

5

Amounts subcontracted to other persons for additions or improvements to real property. Attach list of

6.

subcontractors and addresses, items subcontracted and amounts.

6

TOTAL - Part A -

add lines 1-6

7.

7

Part B

1.

FUEL TAX

a. Gasoline Tax Paid:

# of Gallons

Federal

State

b. Diesel Fuel:

# of Gallons

Federal

State

c. State Special Tax:

# of Gallons

Federal

d. Kerosene:

# of Gallons

e. Liquefied Gas:

# of Gallons

Federal

State

2.

TOBACCO TAX

TOTAL B(1)

a. Cigarettes:

# 20 Packs

Federal

# 25 Packs

State

b. Other Tobacco Products:

Federal

State

3.

BEER

TOTAL B(2)

a. Beer:

Gallons

Barrels

Federal

State

b. 17% of Wholesaler's Cost per beer sold:

4.

OTHER DEDUCTIONS

TOTAL B(3)

Other:

TOTAL B(4)

TOTAL -- Part B -- add Totals for B(1)-B(4)

TOTAL PART B

Part C

TOTALS Parts A and B

Add Part A and Part B Totals and place on Line 2 on front side of report

MULTIPLE LOCATIONS

If return is filed for more than one location, list locations separately below along with requested information.

Street, Address, City, State, Zip

Gross Sales

Deductions

1. Gross Taxable Sales for Tax Purposes to the State of Tennessee

$

Sales Tax

2. Total Amount of Deductions for State Sales Tax Purposes for Tax Period (from Schedule A on the State Tax Return)

$

Reports

3. Total Amount of Sales Tax Due State for Tax period. (Line 14 State Tax return)

$

The amounts reflected above should equal the total of these items on all State Sales and Use Tax Returns for tax period, including any monthly returns which may be delinquent.

Payment for the amount of business tax due may be made by cash, check, or credit card

(VISA, MasterCard or Discover).

If using a credit card, please enclose a Credit Card Authorization Form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8