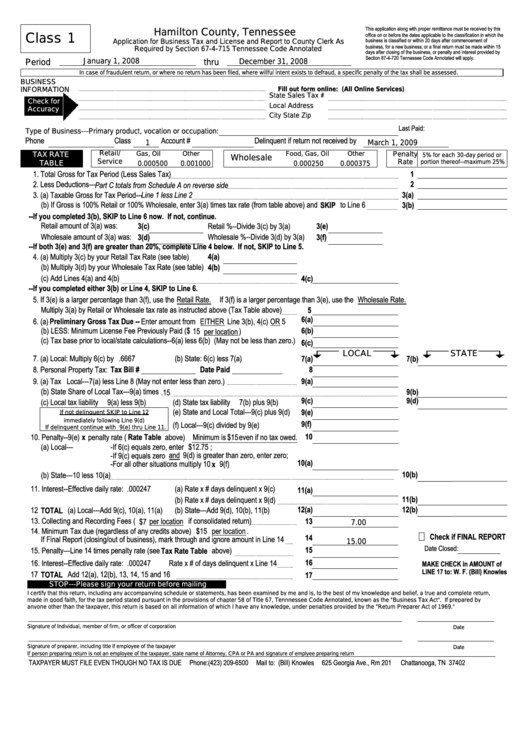

Application For Business Tax And License And Report To County Clerk As Required By Section 67-4-715 Tennessee Code Annotated - 2008

ADVERTISEMENT

This application along with proper remittance must be received by this

Hamilton County, Tennessee

Class

1

office on or before the dates applicable to the classification in which the

business is classified or within 20 days after commencement of

Application for Business Tax and License and Report to County Clerk As

business, for a new business, or a final return must be made within 15

Required by Section 67-4-715 Tennessee Code Annotated

days after closing of the business, or penalty and interest provided by

Section 87-4-720 Tennessee Code Annotated will apply.

January 1, 2008

Period

thru

December 31, 2008

In case of fraudulent return, or where no return has been filed, where willful intent exists to defraud, a specific penalty of the tax shall be assessed.

BUSINESS

INFORMATION

Fill out form online: (All Online Services)

State Sales Tax #

Check for

Local Address

Accuracy

City State Zip

Last Paid:

Type of Business---Primary product, vocation or occupation:

Phone

Class

Account #

Delinquent if return not received by

1

March 1, 2009

Retail/

Gas, Oil

Other

Food, Gas, Oil

Other

Penalty

TAX RATE

5% for each 30-day period or

Wholesale

Service

Rate

portion thereof--maximum 25%

TABLE

0.000500

0.001000

0.000250

0.000375

1. Total Gross for Tax Period (Less Sales Tax)

1

2. Less Deductions---

2

Part C totals from Schedule A on reverse side

3. (a) Taxable Gross for Tax Period---

Line 1 less Line 2

3(a)

(b) If Gross is 100% Retail or 100% Wholesale, enter 3(a) times tax rate (from table above) and SKIP to Line 6

3(b)

--If you completed 3(b), SKIP to Line 6 now. If not, continue.

Retail amount of 3(a) was:

3(c)

Retail %--Divide 3(c) by 3(a)

3(e)

Wholesale amount of 3(a) was:

3(d)

Wholesale %--Divide 3(d) by 3(a)

3(f)

--If both 3(e) and 3(f) are greater than 20%, complete Line 4 below. If not, SKIP to Line 5.

4. (a) Multiply 3(c) by your Retail Tax Rate (see table)

4(a)

(b) Multiply 3(d) by your Wholesale Tax Rate (see table)

4(b)

(c) Add Lines 4(a) and 4(b)

4(c)

--If you completed either 3(b) or Line 4, SKIP to Line 6.

5. If 3(e) is a larger percentage than 3(f), use the

Retail Rate.

If 3(f) is a larger percentage than 3(e), use the

Wholesale Rate.

Multiply 3(a) by Retail or Wholesale tax rate as instructed above (Tax Table above)

5

6(a)

6. (a)

Preliminary Gross Tax Due -- Enter amount from

EITHER

Line 3(b), 4(c)

OR 5

(b) LESS: Minimum License Fee Previously Paid ($

6(b)

15

per location )

(c) Tax base prior to local/state calculations--6(a) less 6(b) (May not be less than zero.)

.

6(c)

LOCAL

STATE

7. (a) Local: Multiply 6(c) by

.6667

(b) State: 6(c) less 7(a)

7(a)

7(b)

8. Personal Property Tax: Tax Bill #

Date Paid

8

9(a)

9. (a) Tax Local---7(a) less Line 8 (May not enter less than zero.)

(b) State Share of Local Tax---9(a) times

9(b)

.15

9(c)

9(d)

(c) Local tax liability

9(a) less 9(b)

(d) State tax liability

7(b) plus 9(b)

If not delinquent SKIP to Line 12

(e) State and Local Total---9(c) plus 9(d)

9(e)

immediately following Line 9(d)

9(f)

(f) Local---9(c) divided by 9(e)

If delinquent continue with 9(e) thru Line 11.

10

10. Penalty--9(e) penalty rate (

x

Rate Table above) Minimum is

$15

even if no tax owed.

(a) Local---

-If 6(c) equals zero, enter

$12.75

;

-If 9(c) equals zero and 9(d) is greater than zero, enter zero;

10(a)

-For all other situations multiply 10 x 9(f)

10(b)

(b) State---10 less 10(a)

11. Interest--Effective daily rate:

.000247

(a) Rate x # days delinquent x 9(c)

11(a)

11(b)

(b) Rate x # days delinquent x 9(d)

12(a)

12(b)

12

TOTAL (a) Local---Add 9(c), 10(a), 11(a)

(b) State---Add 9(d), 10(b), 11(b)

.

13. Collecting and Recording Fees (

$7

per location

if consolidated return)

13

7.00

14. Minimum Tax due (regardless of any credits above)

$15

per location

.

Check if FINAL REPORT

14

-- If Final Report (closing/out of business), mark through and ignore amount in Line 14

15.00

Date Closed:

15

15. Penalty---Line 14 times penalty rate (seeTax Rate Table above)

16

16. Interest--Effective daily rate:

.000247

Rate x # of days delinquent x Line 14

MAKE CHECK in AMOUNT of

LINE 17 to: W. F. (Bill) Knowles

17

TOTAL Add 12(a), 12(b), 13, 14, 15 and 16

17

.

STOP---Please sign your return before mailing

I certify that this return, including any accompanying schedule or statements, has been examined by me and is, to the best of my knowledge and belief, a true and complete return,

made in good faith, for the tax period stated pursuant in the provisions of chapter 58 of Title 67, Tennnessee Code Annotated, known as the "Business Tax Act". If prepared by

anyone other than the taxpayer, this return is based on all information of which I have any knowledge, under penalties provided by the "Return Preparer Act of 1969."

Signature of Individual, member of firm, or officer of corporation

Date

Signature of preparer, including title if employee of the taxpayer

Date

If person preparing return is not an employee of the taxpayer, state name of Attorney, CPA or PA and signature of emplyee preparing return

TAXPAYER MUST FILE EVEN THOUGH NO TAX IS DUE

Phone:(423) 209-6500

Mail to: W.F.(Bill) Knowles

625 Georgia Ave., Rm 201

Chattanooga, TN 37402

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8