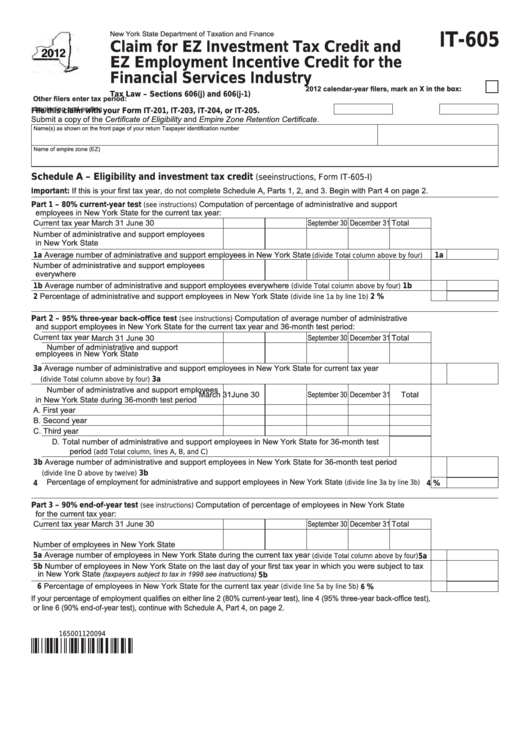

New York State Department of Taxation and Finance

IT-605

Claim for EZ Investment Tax Credit and

EZ Employment Incentive Credit for the

Financial Services Industry

2012 calendar-year filers, mark an X in the box:

Tax Law – Sections 606(j) and 606(j-1)

Other filers enter tax period:

beginning

and ending

File this claim with your Form IT-201, IT-203, IT-204, or IT-205.

Submit a copy of the Certificate of Eligibility and Empire Zone Retention Certificate.

Name(s) as shown on the front page of your return

Taxpayer identification number

Name of empire zone (EZ)

Schedule A – Eligibility and investment tax credit

(see instructions, Form IT-605-I)

Important: If this is your first tax year, do not complete Schedule A, Parts 1, 2, and 3. Begin with Part 4 on page 2.

Computation of percentage of administrative and support

Part 1 – 80% current-year test

(see instructions)

employees in New York State for the current tax year:

Current tax year

March 31

June 30 September 30 December 31

Total

Number of administrative and support employees

in New York State

1a Average number of administrative and support employees in New York State

(divide Total column above by four)

1a

Number of administrative and support employees

everywhere

1b Average number of administrative and support employees everywhere

............ 1b

(divide Total column above by four)

2 Percentage of administrative and support employees in New York State

.........................

2

%

(divide line 1a by line 1b)

– 95% three-year back-office test

Computation of average number of administrative

Part

2

(see instructions)

and support employees in New York State for the current tax year and 36-month test period:

Current tax year

March 31

June 30 September 30 December 31

Total

Number of administrative and support

employees in New York State

3a Average number of administrative and support employees in New York State for current tax year

.......................................................................................................................... 3a

(divide Total column above by four)

Number of administrative and support employees

March 31

June 30 September 30 December 31

Total

in New York State during 36-month test period

A. First year

B. Second year

C. Third year

D. Total number of administrative and support employees in New York State for 36-month test

period

..................................................................................

(add Total column, lines A, B, and C)

3b Average number of administrative and support employees in New York State for 36-month test period

................................................................................................................................ 3b

(divide line D above by twelve)

4 Percentage of employment for administrative and support employees in New York State

.....

4

%

(divide line 3a by line 3b)

Computation of percentage of employees in New York State

Part 3 – 90% end-of-year test

(see instructions)

for the current tax year:

Current tax year

March 31

June 30 September 30 December 31

Total

Number of employees in New York State

5a Average number of employees in New York State during the current tax year

.... 5a

(divide Total column above by four)

5b Number of employees in New York State on the last day of your first tax year in which you were subject to tax

in New York State

....................................................................... 5b

(taxpayers subject to tax in 1998 see instructions)

6 Percentage of employees in New York State for the current tax year

...............................

(divide line 5a by line 5b)

6

%

If your percentage of employment qualifies on either line 2 (80% current-year test), line 4 (95% three-year back-office test),

or line 6 (90% end-of-year test), continue with Schedule A, Part 4, on page 2.

165001120094

1

1 2

2 3

3 4

4