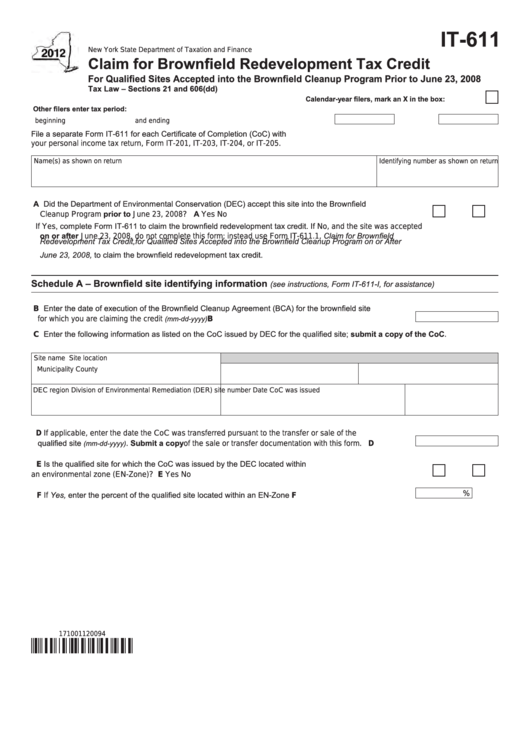

IT-611

New York State Department of Taxation and Finance

Claim for Brownfield Redevelopment Tax Credit

For Qualified Sites Accepted into the Brownfield Cleanup Program Prior to June 23, 2008

Tax Law – Sections 21 and 606(dd)

Calendar-year filers, mark an X in the box:

Other filers enter tax period:

beginning

and ending

File a separate Form IT-611 for each Certificate of Completion (CoC) with

your personal income tax return, Form IT-201, IT-203, IT-204, or IT-205.

Identifying number as shown on return

Name(s) as shown on return

A Did the Department of Environmental Conservation (DEC) accept this site into the Brownfield

Cleanup Program prior to June 23, 2008? ........................................................................................ A

Yes

No

If Yes, complete Form IT-611 to claim the brownfield redevelopment tax credit. If No, and the site was accepted

on or after June 23, 2008, do not complete this form; instead use Form IT-611.1, Claim for Brownfield

Redevelopment Tax Credit, for Qualified Sites Accepted into the Brownfield Cleanup Program on or After

June 23, 2008, to claim the brownfield redevelopment tax credit.

Schedule A – Brownfield site identifying information

(see instructions, Form IT-611-I, for assistance)

B Enter the date of execution of the Brownfield Cleanup Agreement (BCA) for the brownfield site

(mm-dd-yyyy)

for which you are claiming the credit

............................................................................... B

C Enter the following information as listed on the CoC issued by DEC for the qualified site; submit a copy of the CoC.

Site name

Site location

Municipality

County

DEC region

Division of Environmental Remediation (DER) site number Date CoC was issued

D If applicable, enter the date the CoC was transferred pursuant to the transfer or sale of the

qualified site

. Submit a copy of the sale or transfer documentation with this form. ...... D

(mm-dd-yyyy)

E Is the qualified site for which the CoC was issued by the DEC located within

an environmental zone (EN-Zone)? .................................................................................................... E

Yes

No

F If Yes, enter the percent of the qualified site located within an EN-Zone ............................................... F

%

171001120094

1

1 2

2 3

3 4

4