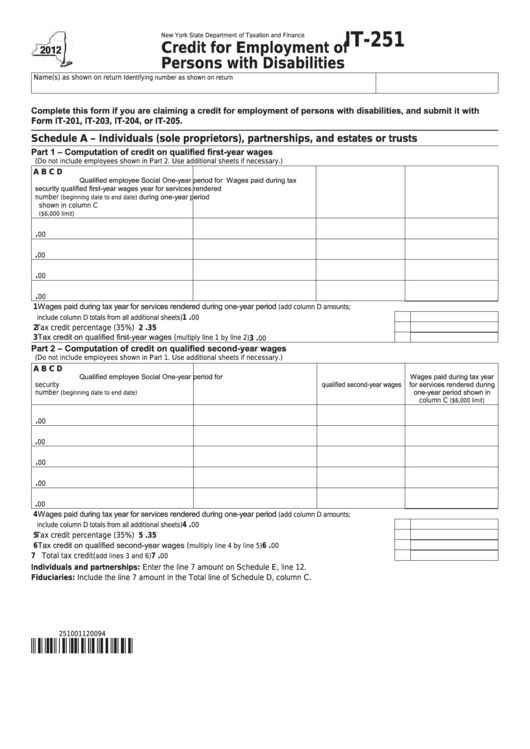

New York State Department of Taxation and Finance

IT-251

Credit for Employment of

Persons with Disabilities

Name(s) as shown on return

Identifying number as shown on return

Complete this form if you are claiming a credit for employment of persons with disabilities, and submit it with

Form IT-201, IT-203, IT-204, or IT-205.

Schedule A – Individuals (sole proprietors), partnerships, and estates or trusts

Part 1 – Computation of credit on qualified first‑year wages

(Do not include employees shown in Part 2. Use additional sheets if necessary.)

A

B

C

D

Qualified employee

Social

One‑year period for

Wages paid during tax

security

qualified first‑year wages

year for services rendered

number

during one‑year period

(beginning date to end date)

shown in column C

($6,000 limit)

00

.

00

.

00

.

00

.

1 Wages paid during tax year for services rendered during one‑year period

(add column D amounts;

...........................................................................................

00

.

1

include column D totals from all additional sheets)

2 Tax credit percentage (35%) ....................................................................................................................

.

2

35

3 Tax credit on qualified first‑year wages (

................................................................

00

multiply line 1 by line 2)

.

3

Part 2 – Computation of credit on qualified second‑year wages

(Do not include employees shown in Part 1. Use additional sheets if necessary.)

A

B

C

D

Qualified employee

Social

One‑year period for

Wages paid during tax year

security

qualified second‑year wages

for services rendered during

number

one‑year period shown in

(beginning date to end date)

column C

($6,000 limit)

00

.

00

.

00

.

00

.

00

.

4 Wages paid during tax year for services rendered during one‑year period

(add column D amounts;

...........................................................................................

00

.

4

include column D totals from all additional sheets)

5 Tax credit percentage (35%) ....................................................................................................................

.

5

35

6 Tax credit on qualified second‑year wages (

..........................................................

00

.

6

multiply line 4 by line 5)

7 Total tax credit (

..............................................................................................................

00

.

7

add lines 3 and 6)

Individuals and partnerships: Enter the line 7 amount on Schedule E, line 12.

Fiduciaries: Include the line 7 amount in the Total line of Schedule D, column C.

251001120094

1

1 2

2