Form Ct-5.1 - Request For Additional Extension Of Time To File - 2012

ADVERTISEMENT

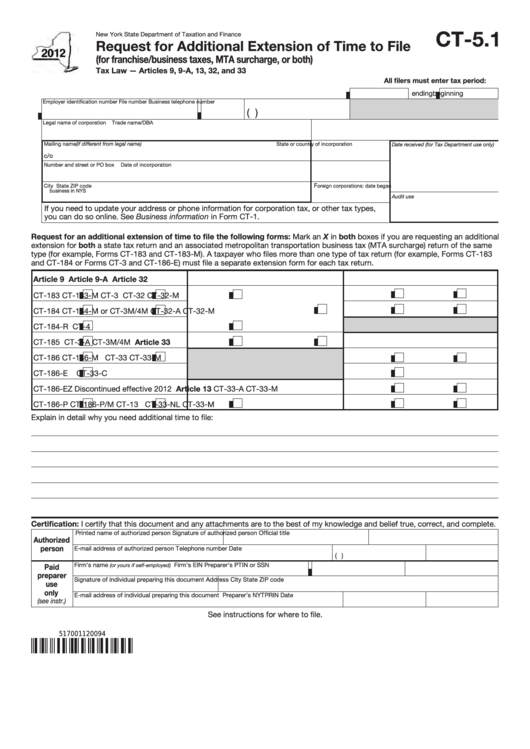

CT-5.1

New York State Department of Taxation and Finance

Request for Additional Extension of Time to File

(for franchise/business taxes, MTA surcharge, or both)

Tax Law — Articles 9, 9-A, 13, 32, and 33

All filers must enter tax period:

beginning

ending

Employer identification number

File number

Business telephone number

(

)

Legal name of corporation

Trade name/DBA

Mailing name (if different from legal name)

State or country of incorporation

Date received (for Tax Department use only)

c/o

Number and street or PO box

Date of incorporation

F

City

State

ZIP code

oreign corporations: date began

business in NYS

Audit use

If you need to update your address or phone information for corporation tax, or other tax types,

you can do so online. See Business information in Form CT-1.

Request for an additional extension of time to file the following forms: Mark an X in both boxes if you are requesting an additional

extension for both a state tax return and an associated metropolitan transportation business tax (MTA surcharge) return of the same

type (for example, Forms CT-183 and CT-183-M). A taxpayer who files more than one type of tax return (for example, Forms CT-183

and CT-184 or Forms CT-3 and CT-186-E) must file a separate extension form for each tax return.

Article 9

Article 9-A

Article 32

CT-183

CT-183-M

CT-3

CT-32

CT-32-M

CT-184

CT-184-M

or

CT-3M/4M

CT-32-A

CT-32-M

CT-184-R

CT-4

CT-185

CT-3-A

CT-3M/4M

Article 33

CT-186

CT-186-M

CT-33

CT-33-M

CT-186-E

CT-33-C

CT-186-EZ

Discontinued effective 2012

Article 13

CT-33-A

CT-33-M

CT-186-P

CT-186-P/M

CT-13

CT-33-NL

CT-33-M

Explain in detail why you need additional time to file:

Certification: I certify that this document and any attachments are to the best of my knowledge and belief true, correct, and complete.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

Paid

(or yours if self-employed)

preparer

Signature of individual preparing this document

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this document

Preparer’s NYTPRIN

Date

(see instr.)

See instructions for where to file.

517001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2