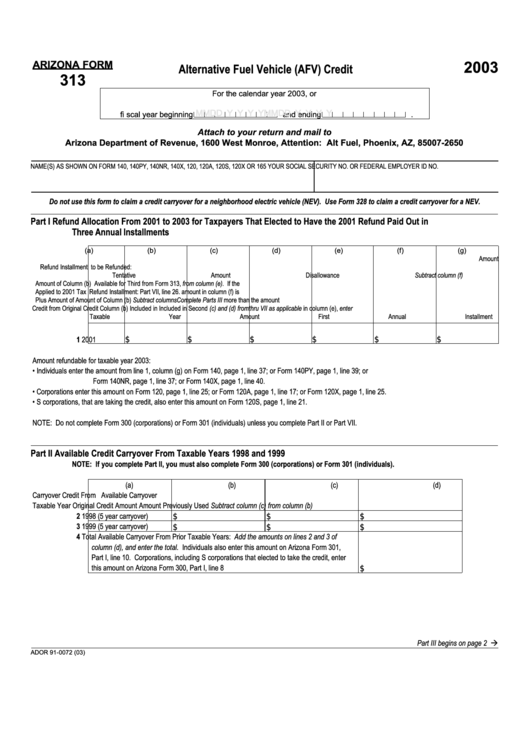

2003

ARIZONA FORM

Alternative Fuel Vehicle (AFV) Credit

313

For the calendar year 2003, or

M M D D Y Y Y Y

M M D D Y Y Y Y

fi scal year beginning

and ending

.

Attach to your return and mail to

Arizona Department of Revenue, 1600 West Monroe, Attention: Alt Fuel, Phoenix, AZ, 85007-2650

NAME(S) AS SHOWN ON FORM 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X OR 165

YOUR SOCIAL SECURITY NO. OR FEDERAL EMPLOYER ID NO.

Do not use this form to claim a credit carryover for a neighborhood electric vehicle (NEV). Use Form 328 to claim a credit carryover for a NEV.

Part I

Refund Allocation From 2001 to 2003 for Taxpayers That Elected to Have the 2001 Refund Paid Out in

Three Annual Installments

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Amount Available

Refund Installment

to be Refunded:

Tentative Amount

Disallowance

Subtract column (f)

Amount of Column (b)

Available for Third

from Form 313,

from column (e). If the

Applied to 2001 Tax

Refund Installment:

Part VII, line 26.

amount in column (f) is

Plus Amount of

Amount of Column (b)

Subtract columns

Complete Parts III

more than the amount

Credit from

Original Credit

Column (b) Included in Included in Second

(c) and (d) from

thru VII as applicable

in column (e), enter

Taxable Year

Amount

First Annual Installment Annual Installment

column (b).

before entering amount. zero in column (g).

$

$

$

$

$

$

1

2001

Amount refundable for taxable year 2003:

• Individuals enter the amount from line 1, column (g) on Form 140, page 1, line 37; or Form 140PY, page 1, line 39; or

Form 140NR, page 1, line 37; or Form 140X, page 1, line 40.

• Corporations enter this amount on Form 120, page 1, line 25; or Form 120A, page 1, line 17; or Form 120X, page 1, line 25.

• S corporations, that are taking the credit, also enter this amount on Form 120S, page 1, line 21.

NOTE: Do not complete Form 300 (corporations) or Form 301 (individuals) unless you complete Part II or Part VII.

Part II

Available Credit Carryover From Taxable Years 1998 and 1999

NOTE: If you complete Part II, you must also complete Form 300 (corporations) or Form 301 (individuals).

(a)

(b)

(c)

(d)

Carryover Credit From

Available Carryover

Taxable Year

Original Credit Amount

Amount Previously Used

Subtract column (c) from column (b)

2

1998 (5 year carryover)

$

$

$

3

1999 (5 year carryover)

$

$

$

4

Total Available Carryover From Prior Taxable Years: Add the amounts on lines 2 and 3 of

column (d), and enter the total. Individuals also enter this amount on Arizona Form 301,

Part I, line 10. Corporations, including S corporations that elected to take the credit, enter

this amount on Arizona Form 300, Part I, line 8

$

Part III begins on page 2

ADOR 91-0072 (03)

1

1 2

2 3

3