Underpayment Of Estimated Tax By Residents - Louisiana Department Of Revenue - 2002

ADVERTISEMENT

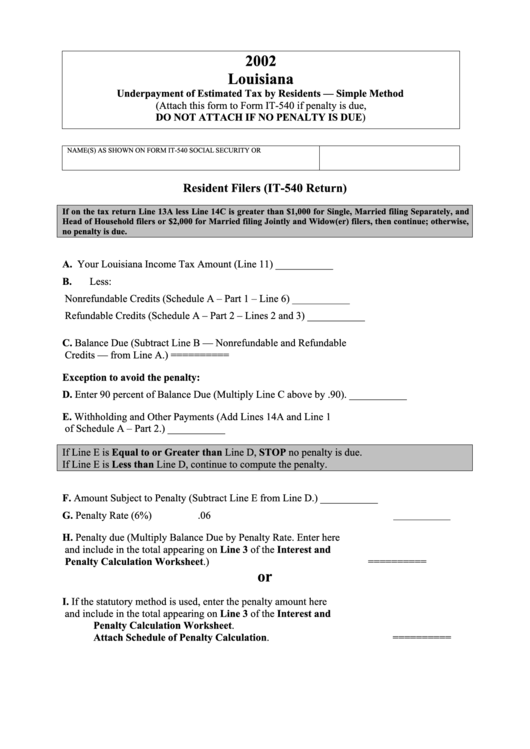

2002

Louisiana

Underpayment of Estimated Tax by Residents — Simple Method

(Attach this form to Form IT-540 if penalty is due,

DO NOT ATTACH IF NO PENALTY IS DUE)

NAME(S) AS SHOWN ON FORM IT-540

SOCIAL SECURITY OR I.D. NUMBER

Resident Filers (IT-540 Return)

If on the tax return Line 13A less Line 14C is greater than $1,000 for Single, Married filing Separately, and

Head of Household filers or $2,000 for Married filing Jointly and Widow(er) filers, then continue; otherwise,

no penalty is due.

A.

Your Louisiana Income Tax Amount (Line 11)

___________

B.

Less:

Nonrefundable Credits (Schedule A – Part 1 – Line 6)

___________

Refundable Credits (Schedule A – Part 2 – Lines 2 and 3)

___________

C.

Balance Due (Subtract Line B — Nonrefundable and Refundable

Credits — from Line A.)

==========

Exception to avoid the penalty:

D.

Enter 90 percent of Balance Due (Multiply Line C above by .90).

___________

E.

Withholding and Other Payments (Add Lines 14A and Line 1

of Schedule A – Part 2.)

___________

If Line E is Equal to or Greater than Line D, STOP no penalty is due.

If Line E is Less than Line D, continue to compute the penalty.

F.

Amount Subject to Penalty (Subtract Line E from Line D.)

___________

G.

Penalty Rate (6%)

.06

H.

Penalty due (Multiply Balance Due by Penalty Rate. Enter here

and include in the total appearing on Line 3 of the Interest and

Penalty Calculation Worksheet.)

==========

or

I.

If the statutory method is used, enter the penalty amount here

and include in the total appearing on Line 3 of the Interest and

Penalty Calculation Worksheet.

Attach Schedule of Penalty Calculation.

==========

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1