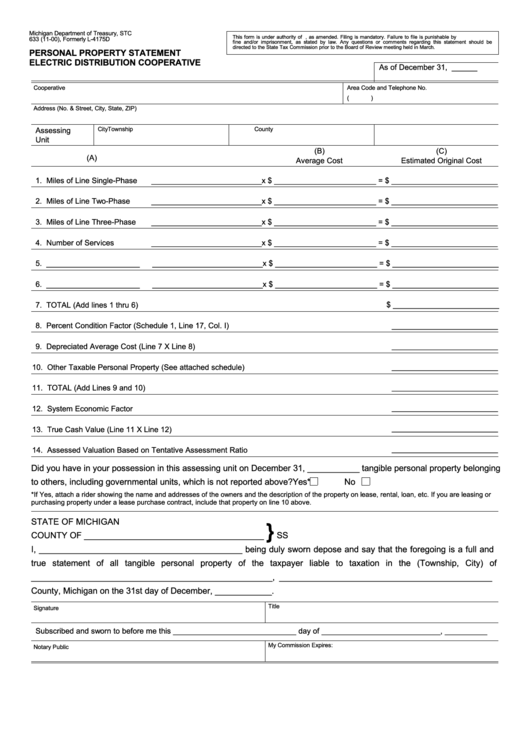

Form 633 - Personal Property Statement Electric Distribution Cooperative

ADVERTISEMENT

Michigan Department of Treasury, STC

This form is under authority of P.A. 206 of 1893, as amended. Filing is mandatory. Failure to file is punishable by

633 (11-00), Formerly L-4175D

fine and/or imprisonment, as stated by law. Any questions or comments regarding this statement should be

directed to the State Tax Commission prior to the Board of Review meeting held in March.

PERSONAL PROPERTY STATEMENT

ELECTRIC DISTRIBUTION COOPERATIVE

As of December 31, ______

Cooperative

Area Code and Telephone No.

(

)

Address (No. & Street, City, State, ZIP)

Assessing

City

Township

County

Unit

(B)

(C)

(A)

Average Cost

Estimated Original Cost

1. Miles of Line Single-Phase

__________________________x $ ________________________ = $ _________________________

2. Miles of Line Two-Phase

__________________________x $ ________________________ = $ _________________________

3. Miles of Line Three-Phase

__________________________x $ ________________________ = $ _________________________

4. Number of Services

__________________________x $ ________________________ = $ _________________________

5. ______________________

__________________________x $ ________________________ = $ _________________________

6. ______________________

__________________________x $ ________________________ = $ _________________________

$ _________________________

7. TOTAL (Add lines 1 thru 6)

_________________________

8. Percent Condition Factor (Schedule 1, Line 17, Col. I)

9. Depreciated Average Cost (Line 7 X Line 8)

_________________________

_________________________

10. Other Taxable Personal Property (See attached schedule)

_________________________

11. TOTAL (Add Lines 9 and 10)

_________________________

12. System Economic Factor

_________________________

13. True Cash Value (Line 11 X Line 12)

_________________________

14. Assessed Valuation Based on Tentative Assessment Ratio

Did you have in your possession in this assessing unit on December 31, ___________ tangible personal property belonging

to others, including governmental units, which is not reported above?

Yes*

No

*If Yes, attach a rider showing the name and addresses of the owners and the description of the property on lease, rental, loan, etc. If you are leasing or

purchasing property under a lease purchase contract, include that property on line 10 above.

STATE OF MICHIGAN

}

COUNTY OF ______________________________________

SS

I, ___________________________________________ being duly sworn depose and say that the foregoing is a full and

true statement of all tangible personal property of the taxpayer liable to taxation in the (Township, City) of

___________________________________________________, _____________________________________________

County, Michigan on the 31st day of December, ____________.

Title

Signature

Subscribed and sworn to before me this _____________________________ day of ____________________________, __________

My Commission Expires:

Notary Public

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1