Form K-2mt - W-2 Specifications For Electronic Filing Efw2 Format - 2012

ADVERTISEMENT

Electronic Services

phone: 785-296-6993

915 SW Harrison St.

fax: 785-525-3901

Topeka, KS 66612-1588

Nick Jordan, Secretary

Sam Brownback, Governor

Steve Stotts, Director of Taxation

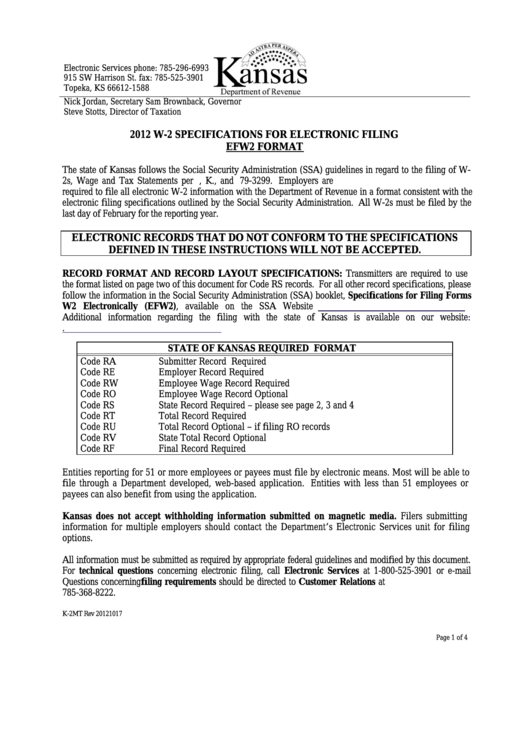

2012 W-2 SPECIFICATIONS FOR ELECTRONIC FILING

EFW2 FORMAT

The state of Kansas follows the Social Security Administration (SSA) guidelines in regard to the filing of W-

2s, Wage and Tax Statements per K.S.A. 79-3222, K.S.A. 79-3296, and K.S.A. 79-3299. Employers are

required to file all electronic W-2 information with the Department of Revenue in a format consistent with the

electronic filing specifications outlined by the Social Security Administration. All W-2s must be filed by the

last day of February for the reporting year.

ELECTRONIC RECORDS THAT DO NOT CONFORM TO THE SPECIFICATIONS

DEFINED IN THESE INSTRUCTIONS WILL NOT BE ACCEPTED.

RECORD FORMAT AND RECORD LAYOUT SPECIFICATIONS: Transmitters are required to use

the format listed on page two of this document for Code RS records. For all other record specifications, please

follow the information in the Social Security Administration (SSA) booklet, Specifications for Filing Forms

W2 Electronically (EFW2), available on the SSA Website

Additional information regarding the filing with the state of Kansas is available on our

website:

STATE OF KANSAS REQUIRED FORMAT

Code RA

Submitter Record

Required

Code RE

Employer Record

Required

Code RW

Employee Wage Record

Required

Code RO

Employee Wage Record

Optional

Code RS

State Record

Required – please see page 2, 3 and 4

Code RT

Total Record

Required

Code RU

Total Record

Optional – if filing RO records

Code RV

State Total Record

Optional

Code RF

Final Record

Required

Entities reporting for 51 or more employees or payees must file by electronic means. Most will be able to

file through a Department developed, web-based application. Entities with less than 51 employees or

payees can also benefit from using the application.

Kansas does not accept withholding information submitted on magnetic media. Filers submitting

information for multiple employers should contact the Department’s Electronic Services unit for filing

options.

All information must be submitted as required by appropriate federal guidelines and modified by this document.

For technical questions concerning electronic filing, call Electronic Services at 1-800-525-3901 or e-mail

w2efile@kdor.ks.gov. Questions concerning filing requirements should be directed to Customer Relations at

785-368-8222.

K-2MT Rev 20121017

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4