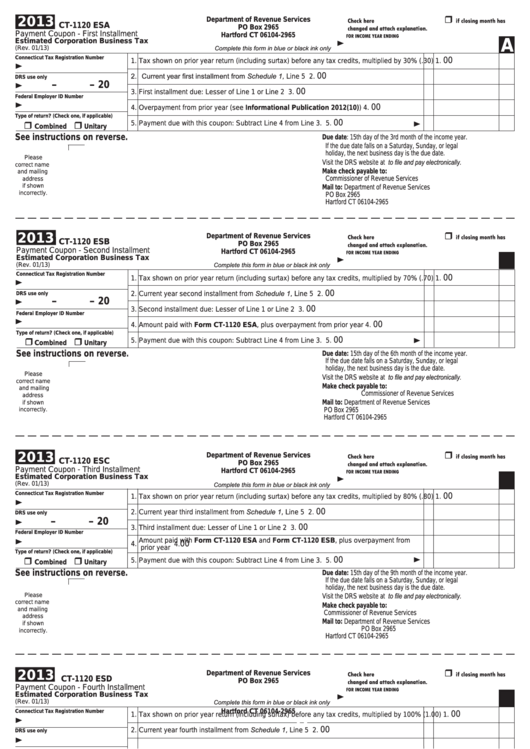

Form Ct-1120 Esa - Payment Coupon - First Installment Estimated Corporation Business Tax - 2013

ADVERTISEMENT

2013

Department of Revenue Services

Check here

if closing month has

CT-1120 ESA

PO Box 2965

changed and attach explanation.

Payment Coupon - First Installment

Hartford CT 06104-2965

FOR INCOME YEAR ENDING

Estimated Corporation Business Tax

A

Complete this form in blue or black ink only

(Rev. 01/13)

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 30% (.30)

1.

2. Current year first installment from Schedule 1, Line 5

00

2.

DRS use only

–

– 20

00

3. First installment due: Lesser of Line 1 or Line 2

3.

Federal Employer ID Number

00

4. Overpayment from prior year (see Informational Publication 2012(10))

4.

Type of return? (Check one, if applicable)

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

Combined

Unitary

See instructions on reverse.

Due date:

15th day of the 3rd month of the income year.

If the due date falls on a Saturday, Sunday, or legal

holiday, the next business day is the due date.

Please

Visit the DRS website at to file and pay electronically.

correct name

Make check payable to:

and mailing

Commissioner of Revenue Services

address

if shown

Mail to:

Department of Revenue Services

incorrectly.

PO Box 2965

Hartford CT 06104-2965

2013

Department of Revenue Services

Check here

if closing month has

CT-1120 ESB

PO Box 2965

changed and attach explanation.

Payment Coupon - Second Installment

Hartford CT 06104-2965

FOR INCOME YEAR ENDING

Estimated Corporation Business Tax

B

Complete this form in blue or black ink only

(Rev. 01/13)

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 70% (.70)

1.

2. Current year second installment from Schedule 1, Line 5

00

2.

DRS use only

–

– 20

00

3. Second installment due: Lesser of Line 1 or Line 2

3.

Federal Employer ID Number

00

4. Amount paid with Form CT-1120 ESA, plus overpayment from prior year

4.

Type of return? (Check one, if applicable)

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

Combined

Unitary

See instructions on reverse.

Due date:

15th day of the 6th month of the income year.

If the due date falls on a Saturday, Sunday, or legal

holiday, the next business day is the due date.

Please

Visit the DRS website at to file and pay electronically.

correct name

Make check payable to:

and mailing

Commissioner of Revenue Services

address

Mail to:

Department of Revenue Services

if shown

incorrectly.

PO Box 2965

Hartford CT 06104-2965

2013

Department of Revenue Services

Check here

if closing month has

CT-1120 ESC

PO Box 2965

changed and attach explanation.

Payment Coupon - Third Installment

Hartford CT 06104-2965

FOR INCOME YEAR ENDING

Estimated Corporation Business Tax

C

Complete this form in blue or black ink only

(Rev. 01/13)

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 80% (.80)

1.

2. Current year third installment from Schedule 1, Line 5

00

2.

DRS use only

–

– 20

00

3. Third installment due: Lesser of Line 1 or Line 2

3.

Federal Employer ID Number

Amount paid with Form CT-1120 ESA and Form CT-1120 ESB, plus overpayment from

00

4.

4.

prior year

Type of return? (Check one, if applicable)

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

Combined

Unitary

See instructions on reverse.

Due date:

15th day of the 9th month of the income year.

If the due date falls on a Saturday, Sunday, or legal

holiday, the next business day is the due date.

Visit the DRS website at to file and pay electronically.

Please

correct name

Make check payable to:

and mailing

Commissioner of Revenue Services

address

Mail to:

Department of Revenue Services

if shown

PO Box 2965

incorrectly.

Hartford CT 06104-2965

2013

Department of Revenue Services

Check here

if closing month has

CT-1120 ESD

changed and attach explanation.

PO Box 2965

Payment Coupon - Fourth Installment

Hartford CT 06104-2965

FOR INCOME YEAR ENDING

Estimated Corporation Business Tax

D

Complete this form in blue or black ink only

(Rev. 01/13)

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 100% (1.00)

1.

2. Current year fourth installment from Schedule 1, Line 5

00

2.

DRS use only

–

– 20

00

3. Fourth installment due: Lesser of Line 1 or Line 2

3.

Federal Employer ID Number

4. Amount paid with Form CT-1120 ESA, Form CT-1120 ESB, and Form CT-1120 ESC,

00

4.

plus overpayment from prior year

Type of return? (Check one, if applicable)

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

Combined

Unitary

See instructions on reverse.

Due date:

15th day of the 12th month of the income year.

If the due date falls on a Saturday, Sunday, or legal

holiday, the next business day is the due date.

Please

Visit the DRS website at to file and pay electronically.

correct name

Make check payable to:

and mailing

Commissioner of Revenue Services

address

Mail to:

Department of Revenue Services

if shown

PO Box 2965

incorrectly.

Hartford CT 06104-2965

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2