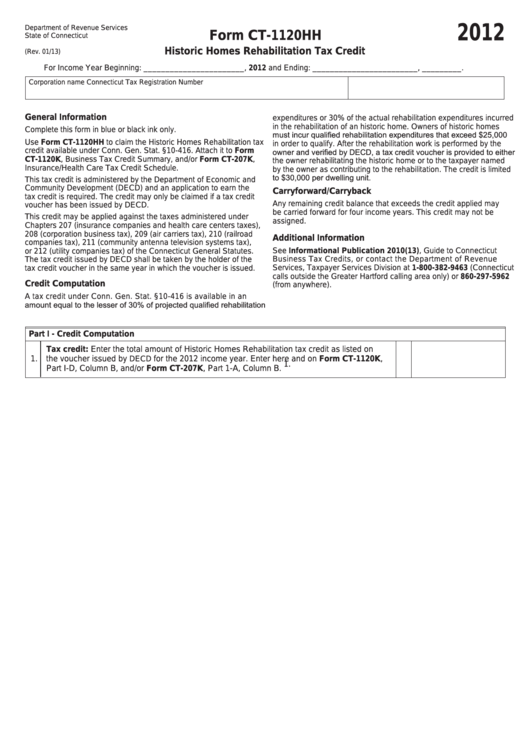

Form Ct-1120hh - Historic Homes Rehabilitation Tax Credit - 2012

ADVERTISEMENT

2012

Department of Revenue Services

Form CT-1120HH

State of Connecticut

Historic Homes Rehabilitation Tax Credit

(Rev. 01/13)

For Income Year Beginning: _______________________ , 2012 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

General Information

expenditures or 30% of the actual rehabilitation expenditures incurred

in the rehabilitation of an historic home. Owners of historic homes

Complete this form in blue or black ink only.

must incur qualified rehabilitation expenditures that exceed $25,000

Use Form CT-1120HH to claim the Historic Homes Rehabilitation tax

in order to qualify. After the rehabilitation work is performed by the

owner and verified by DECD, a tax credit voucher is provided to either

credit available under Conn. Gen. Stat. §10-416. Attach it to Form

CT-1120K, Business Tax Credit Summary, and/or Form CT-207K,

the owner rehabilitating the historic home or to the taxpayer named

Insurance/Health Care Tax Credit Schedule.

by the owner as contributing to the rehabilitation. The credit is limited

to $30,000 per dwelling unit.

This tax credit is administered by the Department of Economic and

Community Development (DECD) and an application to earn the

Carryforward/Carryback

tax credit is required. The credit may only be claimed if a tax credit

Any remaining credit balance that exceeds the credit applied may

voucher has been issued by DECD.

be carried forward for four income years. This credit may not be

This credit may be applied against the taxes administered under

assigned.

Chapters 207 (insurance companies and health care centers taxes),

208 (corporation business tax), 209 (air carriers tax), 210 (railroad

Additional Information

companies tax), 211 (community antenna television systems tax),

See Informational Publication 2010(13), Guide to Connecticut

or 212 (utility companies tax) of the Connecticut General Statutes.

The tax credit issued by DECD shall be taken by the holder of the

Business Tax Credits, or contact the Department of Revenue

Services, Taxpayer Services Division at 1-800-382-9463 (Connecticut

tax credit voucher in the same year in which the voucher is issued.

calls outside the Greater Hartford calling area only) or 860-297-5962

Credit Computation

(from anywhere).

A tax credit under Conn. Gen. Stat. §10-416 is available in an

amount equal to the lesser of 30% of projected qualified rehabilitation

Part I - Credit Computation

Tax credit: Enter the total amount of Historic Homes Rehabilitation tax credit as listed on

1.

the voucher issued by

for the 2012 income year. Enter here and on Form CT-1120K,

DECD

1.

Part I-D, Column B, and/or Form CT-207K, Part 1-A, Column B.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2