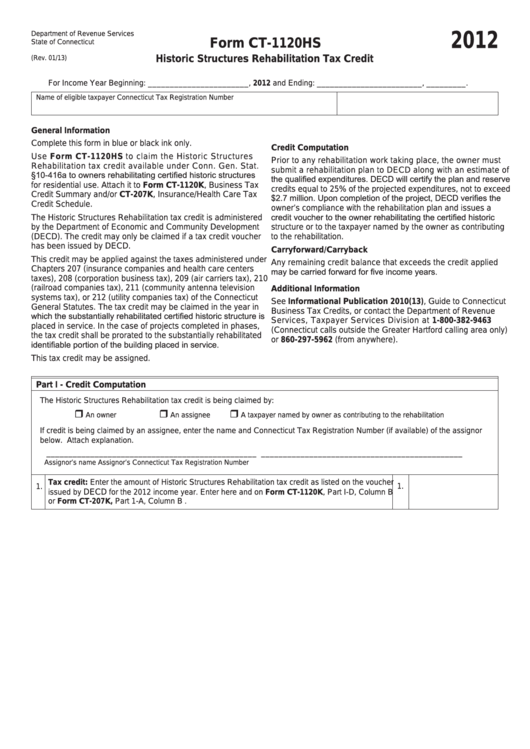

Form Ct-1120hs - Historic Structures Rehabilitation Tax Credit - 2012

ADVERTISEMENT

Department of Revenue Services

2012

Form CT-1120HS

State of Connecticut

Historic Structures Rehabilitation Tax Credit

(Rev. 01/13)

For Income Year Beginning: _______________________ , 2012 and Ending: ________________________ , _________ .

Name of eligible taxpayer

Connecticut Tax Registration Number

General Information

Complete this form in blue or black ink only.

Credit Computation

Use Form CT-1120HS to claim the Historic Structures

Prior to any rehabilitation work taking place, the owner must

Rehabilitation tax credit available under Conn. Gen. Stat.

submit a rehabilitation plan to DECD along with an estimate of

§10-416a to owners rehabilitating certified historic structures

the qualified expenditures. DECD will certify the plan and reserve

for residential use. Attach it to Form CT-1120K, Business Tax

credits equal to 25% of the projected expenditures, not to exceed

Credit Summary and/or CT-207K, Insurance/Health Care Tax

$2.7 million. Upon completion of the project, DECD verifies the

Credit Schedule.

owner’s compliance with the rehabilitation plan and issues a

credit voucher to the owner rehabilitating the certified historic

The Historic Structures Rehabilitation tax credit is administered

by the Department of Economic and Community Development

structure or to the taxpayer named by the owner as contributing

(DECD). The credit may only be claimed if a tax credit voucher

to the rehabilitation.

has been issued by DECD.

Carryforward/Carryback

This credit may be applied against the taxes administered under

Any remaining credit balance that exceeds the credit applied

Chapters 207 (insurance companies and health care centers

may be carried forward for five income years.

taxes), 208 (corporation business tax), 209 (air carriers tax), 210

(railroad companies tax), 211 (community antenna television

Additional Information

systems tax), or 212 (utility companies tax) of the Connecticut

See Informational Publication 2010(13), Guide to Connecticut

General Statutes. The tax credit may be claimed in the year in

Business Tax Credits, or contact the Department of Revenue

which the substantially rehabilitated certified historic structure is

Services, Taxpayer Services Division at 1-800-382-9463

placed in service. In the case of projects completed in phases,

(Connecticut calls outside the Greater Hartford calling area only)

the tax credit shall be prorated to the substantially rehabilitated

or 860-297-5962 (from anywhere).

identifiable portion of the building placed in service.

This tax credit may be assigned.

Part I - Credit Computation

The Historic Structures Rehabilitation tax credit is being claimed by:

An owner

An assignee

A taxpayer named by owner as contributing to the rehabilitation

If credit is being claimed by an assignee, enter the name and Connecticut Tax Registration Number (if available) of the assignor

below. Attach explanation.

________________________________________________

______________________________________________

Assignor’s name

Assignor’s Connecticut Tax Registration Number

Tax credit: Enter the amount of Historic Structures Rehabilitation tax credit as listed on the voucher

1.

1.

DECD

issued by

for the 2012 income year. Enter here and on Form CT-1120K, Part I-D, Column B

or Form CT-207K, Part 1-A, Column B .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2