Form Cit-Pv - New Mexico Corporate Income And Franchise Tax Payment Voucher

ADVERTISEMENT

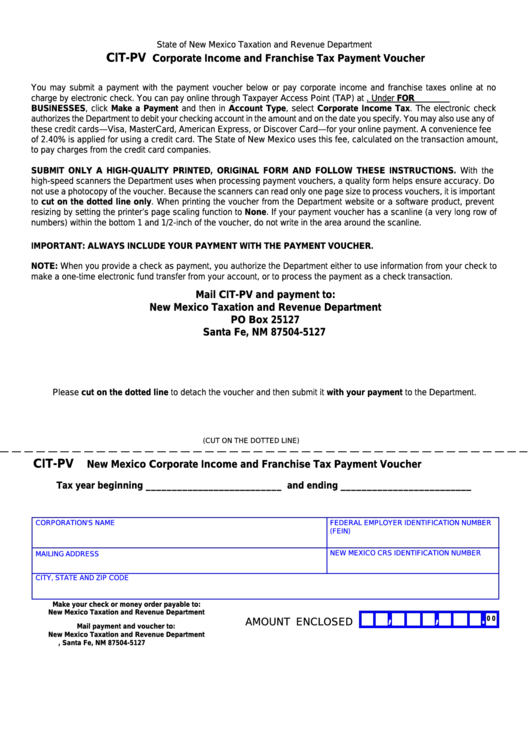

State of New Mexico Taxation and Revenue Department

CIT-PV

Corporate Income and Franchise Tax Payment Voucher

You may submit a payment with the payment voucher below or pay corporate income and franchise taxes online at no

charge by electronic check. You can pay online through Taxpayer Access Point (TAP) at https://tap.state.nm.us. Under FOR

BUSINESSES, click Make a Payment and then in Account Type, select Corporate Income Tax. The electronic check

authorizes the Department to debit your checking account in the amount and on the date you specify. You may also use any of

these credit cards—Visa, MasterCard, American Express, or Discover Card—for your online payment. A convenience fee

of 2.40% is applied for using a credit card. The State of New Mexico uses this fee, calculated on the transaction amount,

to pay charges from the credit card companies.

SUBMIT ONLY A HIGH-QUALITY PRINTED, ORIGINAL FORM AND FOLLOW THESE INSTRUCTIONS. With the

high-speed scanners the Department uses when processing payment vouchers, a quality form helps ensure accuracy. Do

not use a photocopy of the voucher. Because the scanners can read only one page size to process vouchers, it is important

to cut on the dotted line only. When printing the voucher from the Department website or a software product, prevent

resizing by setting the printer’s page scaling function to None. If your payment voucher has a scanline (a very long row of

numbers) within the bottom 1 and 1/2-inch of the voucher, do not write in the area around the scanline.

IMPORTANT: ALWAYS INCLUDE YOUR PAYMENT WITH THE PAYMENT VOUCHER.

NOTE: When you provide a check as payment, you authorize the Department either to use information from your check to

make a one-time electronic fund transfer from your account, or to process the payment as a check transaction.

Mail CIT-PV and payment to:

New Mexico Taxation and Revenue Department

PO Box 25127

Santa Fe, NM 87504-5127

Please cut on the dotted line to detach the voucher and then submit it with your payment to the Department.

(CUT ON THE DOTTED LINE)

CIT-PV

New Mexico Corporate Income and Franchise Tax Payment Voucher

Tax year beginning __________________________ and ending _________________________

CORPORATION'S NAME

FEDERAL EMPLOYER IDENTIFICATION NUMBER

(FEIN)

NEW MEXICO CRS IDENTIFICATION NUMBER

MAILING ADDRESS

CITY, STATE AND ZIP CODE

Make your check or money order payable to:

,

,

.

New Mexico Taxation and Revenue Department

0 0

AMOUNT ENCLOSED

Mail payment and voucher to:

New Mexico Taxation and Revenue Department

P.O. Box 25127, Santa Fe, NM 87504-5127

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1