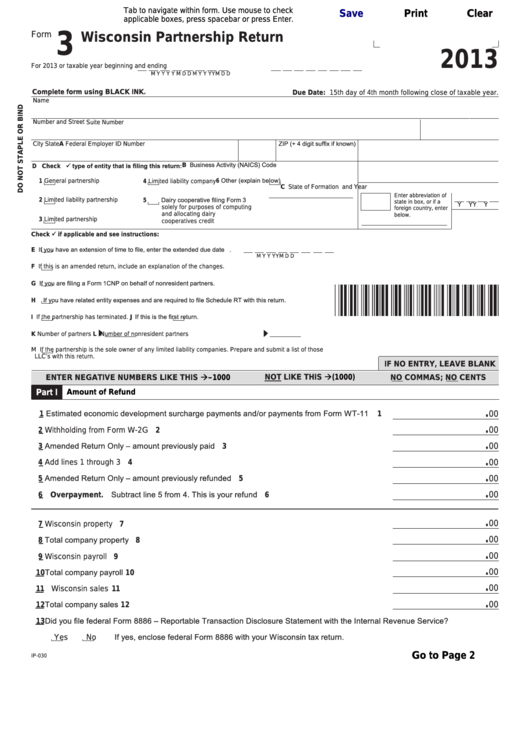

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

Form

3

Wisconsin Partnership Return

2013

For 2013 or taxable year beginning

and ending

M

M

D

D

Y

Y

Y

Y

M

M

D

D

Y

Y

Y

Y

Complete form using BLACK INK.

Due Date: 15th day of 4th month following close of taxable year.

Name

Number and Street

Suite Number

ZIP (+ 4 digit suffix if known)

City

State

A Federal Employer ID Number

B Business Activity (NAICS) Code

type of entity that is filing this return:

D Check

Other (explain below)

1

General partnership

6

4

Limited liability company

C State of Formation

and

Year

Enter abbreviation of

Dairy cooperative filing Form 3

2

Limited liability partnership

5

state in box, or if a

Y

Y

Y

Y

solely for purposes of computing

foreign country, enter

and allocating dairy

below.

3

Limited partnership

cooperatives credit

Check

if applicable and see instructions:

If you have an extension of time to file, enter the extended due date

.

E

M

M

D

D

Y

Y

Y

Y

F

If this is an amended return, include an explanation of the changes.

If you are filing a Form 1CNP on behalf of nonresident partners.

G

If you have related entity expenses and are required to file Schedule RT with this return.

H

If this is the first return.

I

If the partnership has terminated.

J

K Number of partners

L Number of nonresident partners

M

If the partnership is the sole owner of any limited liability companies. Prepare and submit a list of those

LLC’s with this return.

IF NO ENTRY, LEAVE BLANK

(1000)

–1000

ENTER NEGATIVE NUMBERS LIKE THIS

NOT LIKE THIS

NO COMMAS; NO CENTS

Part I

Amount of Refund

.

1 Estimated economic development surcharge payments and/or payments from Form WT-11

1

00

.

2 Withholding from Form W-2G . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

.

3 Amended Return Only – amount previously paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

.

4 Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

.

5 Amended Return Only – amount previously refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

.

6 Overpayment. Subtract line 5 from 4. This is your refund . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

.

00

7 Wisconsin property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.

8 Total company property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

8

.

00

9 Wisconsin payroll . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

.

10 Total company payroll . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

.

00

11 Wisconsin sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.

12 Total company sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

00

13 Did you file federal Form 8886 – Reportable Transaction Disclosure Statement with the Internal Revenue Service?

No If yes, enclose federal Form 8886 with your Wisconsin tax return.

Yes

Go to Page 2

IP-030

1

1 2

2 3

3 4

4