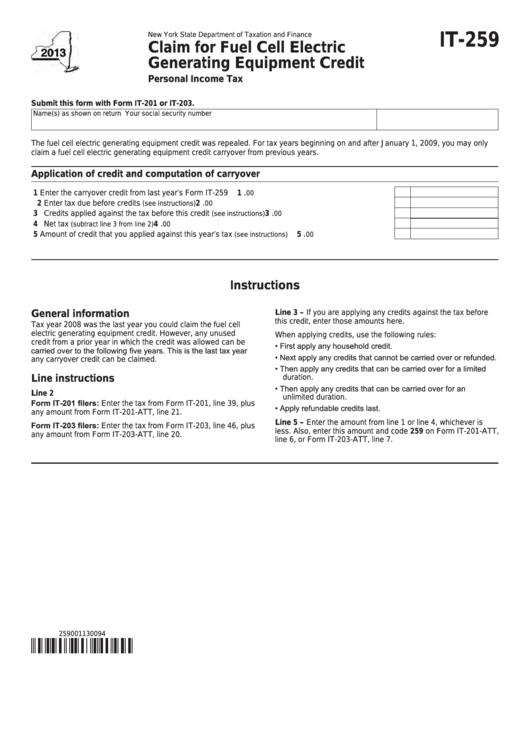

IT-259

New York State Department of Taxation and Finance

Claim for Fuel Cell Electric

Generating Equipment Credit

Personal Income Tax

Submit this form with Form IT-201 or IT-203.

Name(s) as shown on return

Your social security number

The fuel cell electric generating equipment credit was repealed. For tax years beginning on and after January 1, 2009, you may only

claim a fuel cell electric generating equipment credit carryover from previous years.

Application of credit and computation of carryover

.

1 Enter the carryover credit from last year’s Form IT-259 ........................................................................ 1

00

.

2 Enter tax due before credits

......................................................................................... 2

(see instructions)

00

.

3 Credits applied against the tax before this credit

......................................................... 3

(see instructions)

00

.

4 Net tax

............................................................................................................ 4

(subtract line 3 from line 2)

00

.

5 Amount of credit that you applied against this year’s tax

............................................. 5

(see instructions)

00

Instructions

General information

Line 3 – If you are applying any credits against the tax before

this credit, enter those amounts here.

Tax year 2008 was the last year you could claim the fuel cell

electric generating equipment credit. However, any unused

When applying credits, use the following rules:

credit from a prior year in which the credit was allowed can be

• First apply any household credit.

carried over to the following five years. This is the last tax year

• Next apply any credits that cannot be carried over or refunded.

any carryover credit can be claimed.

• Then apply any credits that can be carried over for a limited

duration.

Line instructions

• Then apply any credits that can be carried over for an

Line 2

unlimited duration.

Form IT-201 filers: Enter the tax from Form IT-201, line 39, plus

• Apply refundable credits last.

any amount from Form IT-201-ATT, line 21.

Line 5 – Enter the amount from line 1 or line 4, whichever is

Form IT-203 filers: Enter the tax from Form IT-203, line 46, plus

less. Also, enter this amount and code 259 on Form IT-201-ATT,

any amount from Form IT-203-ATT, line 20.

line 6, or Form IT-203-ATT, line 7.

259001130094

1

1