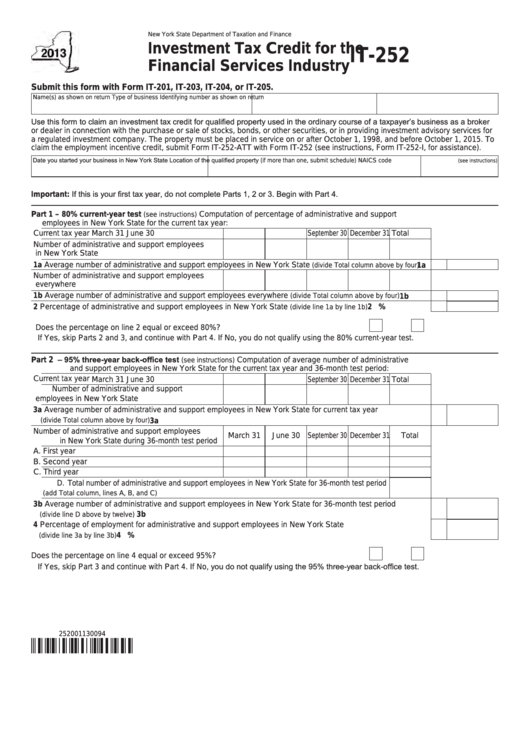

New York State Department of Taxation and Finance

Investment Tax Credit for the

IT-252

Financial Services Industry

Submit this form with Form IT-201, IT-203, IT-204, or IT-205.

Name(s) as shown on return

Type of business

Identifying number as shown on return

Use this form to claim an investment tax credit for qualified property used in the ordinary course of a taxpayer’s business as a broker

or dealer in connection with the purchase or sale of stocks, bonds, or other securities, or in providing investment advisory services for

a regulated investment company. The property must be placed in service on or after October 1, 1998, and before October 1, 2015. To

claim the employment incentive credit, submit Form IT-252-ATT with Form IT-252 (see instructions, Form IT-252-I, for assistance).

Date you started your business in New York State

Location of the qualified property (if more than one, submit schedule)

NAICS code

(see instructions)

Important: If this is your first tax year, do not complete Parts 1, 2 or 3. Begin with Part 4.

Part 1 – 80% current-year test

Computation of percentage of administrative and support

(see instructions)

employees in New York State for the current tax year:

Current tax year

March 31

June 30 September 30 December 31

Total

Number of administrative and support employees

in New York State

1a Average number of administrative and support employees in New York State

....

(divide Total column above by four)

1a

Number of administrative and support employees

everywhere

1b Average number of administrative and support employees everywhere

............

(divide Total column above by four)

1b

2 Percentage of administrative and support employees in New York State

.........................

2

%

(divide line 1a by line 1b)

Does the percentage on line 2 equal or exceed 80%? ..................................................... Yes

No

If Yes, skip Parts 2 and 3, and continue with Part 4. If No, you do not qualify using the 80% current-year test.

– 95% three-year back-office test

2

Part

Computation of average number of administrative

(see instructions)

and support employees in New York State for the current tax year and 36-month test period:

Current tax year

March 31

June 30 September 30 December 31

Total

Number of administrative and support

employees in New York State

3a

Average number of administrative and support employees in New York State for current tax year

.......................................................................................................................

(divide Total column above by four)

3a

Number of administrative and support employees

March 31

June 30 September 30 December 31

Total

in New York State during 36-month test period

A. First year

B. Second year

C. Third year

D. Total number of administrative and support employees in New York State for 36-month test period

...........................................................................................

(add Total column, lines A, B, and C)

3b

Average number of administrative and support employees in New York State for 36-month test period

.............................................................................................................................

3b

(divide line D above by twelve)

4

Percentage of employment for administrative and support employees in New York State

.....................................................................................................................................

4

%

(divide line 3a by line 3b)

Does the percentage on line 4 equal or exceed 95%? ................................................... Yes

No

If Yes, skip Part 3 and continue with Part 4. If No, you do not qualify using the 95% three-year back-office test.

252001130094

1

1 2

2 3

3