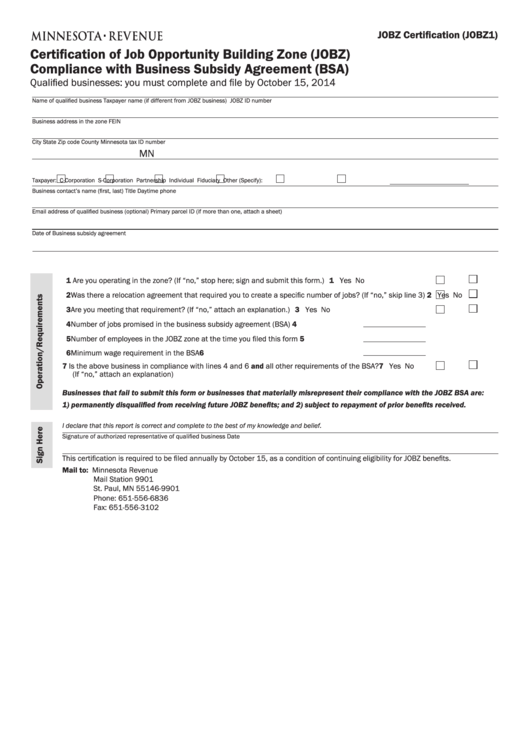

JOBZ Certification (JOBZ1)

Certification of Job Opportunity Building Zone (JOBZ)

Compliance with Business Subsidy Agreement (BSA)

Qualified businesses: you must complete and file by October 15, 2014

Name of qualified business

Taxpayer name (if different from JOBZ business)

JOBZ ID number

Business address in the zone

FEIN

City

State

Zip code

County

Minnesota tax ID number

MN

Taxpayer:

C-Corporation

S-Corporation

Partnership

Individual

Fiduciary

Other (Specify):

Business contact’s name (first, last)

Title

Daytime phone

Email address of qualified business (optional)

Primary parcel ID (if more than one, attach a sheet)

Date of Business subsidy agreement

1 Are you operating in the zone? (If “no,” stop here; sign and submit this form.) . . . . . . . . . . . . . . . . . . . . . . . . . .1

Yes

No

2 Was there a relocation agreement that required you to create a specific number of jobs? (If “no,” skip line 3) 2

Yes

No

3 Are you meeting that requirement? (If “no,” attach an explanation.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

Yes

No

4 Number of jobs promised in the business subsidy agreement (BSA) . . . . . . . . . . . . . . . 4

5 Number of employees in the JOBZ zone at the time you filed this form . . . . . . . . . . . . . 5

6 Minimum wage requirement in the BSA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6

7 Is the above business in compliance with lines 4 and 6 and all other requirements of the BSA? . . . . . . . . . . . .7

Yes

No

(If “no,” attach an explanation)

Businesses that fail to submit this form or businesses that materially misrepresent their compliance with the JOBZ BSA are:

1) permanently disqualified from receiving future JOBZ benefits; and 2) subject to repayment of prior benefits received.

I declare that this report is correct and complete to the best of my knowledge and belief.

Signature of authorized representative of qualified business

Date

This certification is required to be filed annually by October 15, as a condition of continuing eligibility for JOBZ benefits.

Mail to: Minnesota Revenue

Mail Station 9901

St. Paul, MN 55146-9901

Phone: 651-556-6836

Fax: 651-556-3102

1

1 2

2