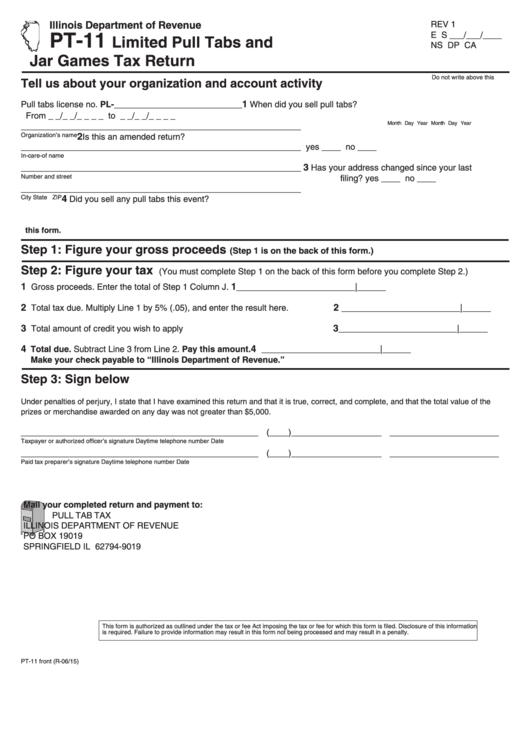

Illinois Department of Revenue

REV 1

PT-11

E S ___/___/____

Limited Pull Tabs and

NS DP CA

Jar Games Tax Return

Station no. 995

Do not write above this line.

Tell us about your organization and account activity

1

Pull tabs license no. PL-___________________________

When did you sell pull tabs?

From _ _/_ _/_ _ _ _ to _ _/_ _/_ _ _ _

Month Day

Year

Month Day

Year

___________________________________________________________

2

Organization’s name

Is this an amended return?

___________________________________________________________

yes ____ no ____

In-care-of name

3

___________________________________________________________

Has your address changed since your last

Number and street

filing? yes ____ no ____

___________________________________________________________

4

City

State

ZIP

Did you sell any pull tabs this event?

yes ____ no ____

If “no,” go to Step 3.

If “yes,” go to Step 1 on the back of

this form.

Step 1: Figure your gross proceeds

(Step 1 is on the back of this form.)

Step 2: Figure your tax

(You must complete Step 1 on the back of this form before you complete Step 2.)

1

1

Gross proceeds. Enter the total of Step 1 Column J.

_________________________|______

2

2

Total tax due. Multiply Line 1 by 5% (.05), and enter the result here.

_________________________|______

3

3

Total amount of credit you wish to apply

_________________________|______

4

4

Total due. Subtract Line 3 from Line 2. Pay this amount.

_________________________|______

Make your check payable to “Illinois Department of Revenue.”

Step 3: Sign below

Under penalties of perjury, I state that I have examined this return and that it is true, correct, and complete, and that the total value of the

prizes or merchandise awarded on any day was not greater than $5,000.

__________________________________________________ (____)___________________ _______________________

Taxpayer or authorized officer’s signature

Daytime telephone number

Date

__________________________________________________ (____)___________________ _______________________

Paid tax preparer’s signature

Daytime telephone number

Date

Mail your completed return and payment to:

PULL TAB TAX

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

SPRINGFIELD IL 62794-9019

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information

is required. Failure to provide information may result in this form not being processed and may result in a penalty.

PT-11 front (R-06/15)

1

1 2

2