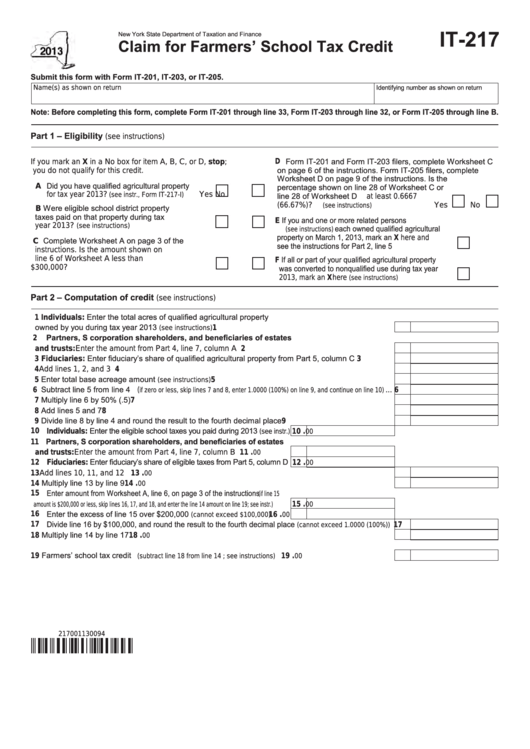

IT-217

New York State Department of Taxation and Finance

Claim for Farmers’ School Tax Credit

Submit this form with Form IT-201, IT-203, or IT-205.

Identifying number as shown on return

Name(s) as shown on return

Note: Before completing this form, complete Form IT-201 through line 33, Form IT-203 through line 32, or Form IT-205 through line B.

Part 1 – Eligibility

(see instructions)

D Form IT-201 and Form IT-203 filers, complete Worksheet C

If you mark an X in a No box for item A, B, C, or D, stop;

on page 6 of the instructions. Form IT-205 filers, complete

you do not qualify for this credit.

Worksheet D on page 9 of the instructions. Is the

A Did you have qualified agricultural property

percentage shown on line 28 of Worksheet C or

line 28 of Worksheet D at least 0.6667

for tax year 2013?

Yes

No

(see instr., Form IT-217-I) .......

(66.67%)?

............................ Yes

No

(see instructions)

B Were eligible school district property

taxes paid on that property during tax

E If you and one or more related persons

year 2013?

......................... Yes

No

(see instructions)

each owned qualified agricultural

(see instructions)

property on March 1, 2013, mark an X here and

C Complete Worksheet A on page 3 of the

see the instructions for Part 2, line 5 ..........................

instructions. Is the amount shown on

F If all or part of your qualified agricultural property

line 6 of Worksheet A less than

was converted to nonqualified use during tax year

$300,000? ................................................... Yes

No

2013, mark an X here

.....................

(see instructions)

Part 2 – Computation of credit

(see instructions)

1 Individuals: Enter the total acres of qualified agricultural property

owned by you during tax year 2013

.........................................................................

1

(see instructions)

2 Partners, S corporation shareholders, and beneficiaries of estates

and trusts: Enter the amount from Part 4, line 7, column A .............................................................

2

3 Fiduciaries: Enter fiduciary’s share of qualified agricultural property from Part 5, column C .............

3

4 Add lines 1, 2, and 3 .............................................................................................................................

4

5 Enter total base acreage amount

................................................................................

5

(see instructions)

6 Subtract line 5 from line 4 (

...

6

if zero or less, skip lines 7 and 8, enter 1.0000 (100%) on line 9, and continue on line 10)

7 Multiply line 6 by 50% (.5) .....................................................................................................................

7

8 Add lines 5 and 7...................................................................................................................................

8

9 Divide line 8 by line 4 and round the result to the fourth decimal place ................................................

9

10 Individuals: Enter the eligible school taxes you paid during 2013

.

10

(see instr.)

00

11 Partners, S corporation shareholders, and beneficiaries of estates

.

and trusts: Enter the amount from Part 4, line 7, column B .............. 11

00

12 Fiduciaries: Enter fiduciary’s share of eligible taxes from Part 5, column D 12

.

00

.

13 Add lines 10, 11, and 12 ....................................................................................................................... 13

00

14 Multiply line 13 by line 9 ........................................................................................................................ 14

.

00

15 Enter amount from Worksheet A, line 6, on page 3 of the instructions

(if line 15

.

15

amount is $200,000 or less, skip lines 16, 17, and 18, and enter the line 14 amount on line 19; see instr.)

00

16 Enter the excess of line 15 over $200,000

.

........ 16

(cannot exceed $100,000)

00

17 Divide line 16 by $100,000, and round the result to the fourth decimal place

17

(cannot exceed 1.0000 (100%))

18 Multiply line 14 by line 17 ...................................................................................................................... 18

.

00

19 Farmers’ school tax credit

.

19

(subtract line 18 from line 14 ; see instructions) ............................................................

00

217001130094

1

1 2

2