Print

Clear

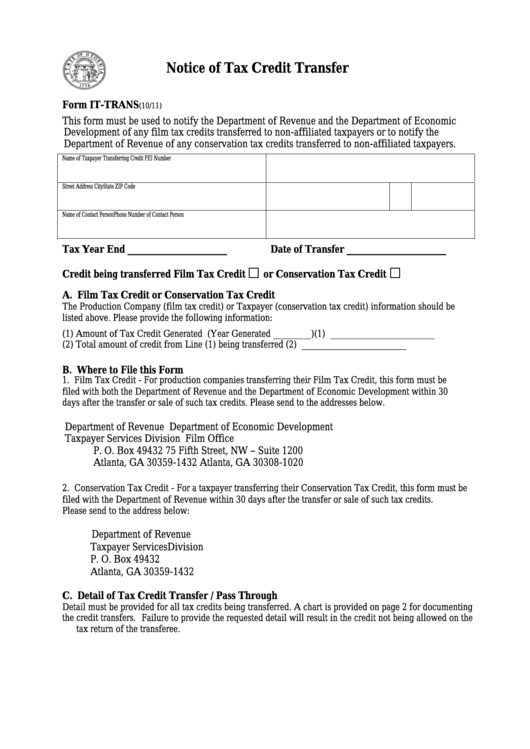

Notice of Tax Credit Transfer

Form IT-TRANS

(10/11)

This form must be used to notify the Department of Revenue and the Department of Economic

Development of any film tax credits transferred to non-affiliated taxpayers or to notify the

Department of Revenue of any conservation tax credits transferred to non-affiliated taxpayers.

Name of Taxpayer Transferring Credit

FEI Number

Street Address

City

State

ZIP Code

Name of Contact Person

Phone Number of Contact Person

Tax Year End ___________________

Date of Transfer ___________________

Credit being transferred Film Tax Credit

or Conservation Tax Credit

A. Film Tax Credit or Conservation Tax Credit

The Production Company (film tax credit) or Taxpayer (conservation tax credit) information should be

listed above. Please provide the following information:

(1) Amount of Tax Credit Generated (Year Generated ________)

(1) ______________________

(2) Total amount of credit from Line (1) being transferred

(2) ______________________

B. Where to File this Form

1. Film Tax Credit - For production companies transferring their Film Tax Credit, this form must be

filed with both the Department of Revenue and the Department of Economic Development within 30

days after the transfer or sale of such tax credits. Please send to the addresses below.

Department of Revenue

Department of Economic Development

Taxpayer Services Division

Film Office

P. O. Box 49432

75 Fifth Street, NW – Suite 1200

Atlanta, GA 30359-1432

Atlanta, GA 30308-1020

2. Conservation Tax Credit - For a taxpayer transferring their Conservation Tax Credit, this form must be

filed with the Department of Revenue within 30 days after the transfer or sale of such tax credits.

Please send to the address below:

Department of Revenue

Taxpayer ServicesDivision

P. O. Box 49432

Atlanta, GA 30359-1432

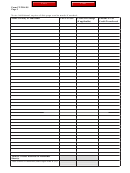

C. Detail of Tax Credit Transfer / Pass Through

Detail must be provided for all tax credits being transferred. A chart is provided on page 2 for documenting

the credit transfers.

Failure to provide the requested detail will result in the credit not being allowed on the

tax return of the transferee.

1

1 2

2