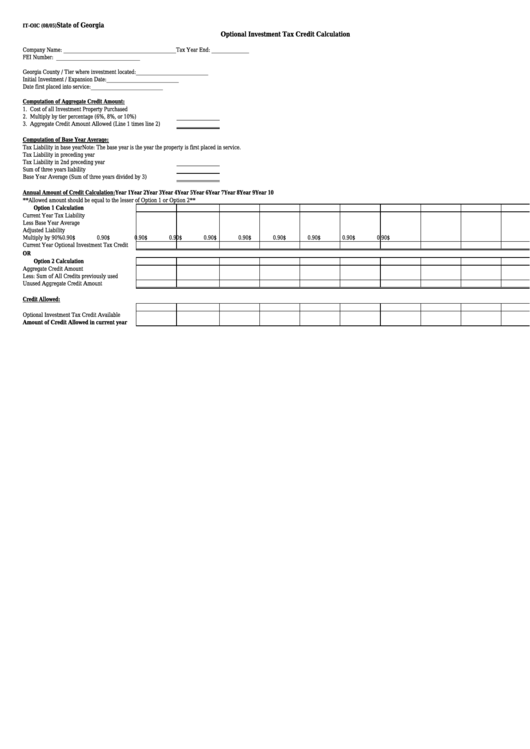

Form It-Oic - Optional Investment Tax Credit Calculation

ADVERTISEMENT

State of Georgia

IT-OIC (08/05)

Optional Investment Tax Credit Calculation

Company Name: _______________________________________

Tax Year End: _____________

FEI Number: _____________________________

Georgia County / Tier where investment located: _________________________

Initial Investment / Expansion Date:

_________________________

Date first placed into service:

_________________________

Computation of Aggregate Credit Amount:

1. Cost of all Investment Property Purchased

2. Multiply by tier percentage (6%, 8%, or 10%)

3. Aggregate Credit Amount Allowed (Line 1 times line 2)

Computation of Base Year Average:

Tax Liability in base year

Note: The base year is the year the property is first placed in service.

Tax Liability in preceding year

Tax Liability in 2nd preceding year

Sum of three years liability

Base Year Average (Sum of three years divided by 3)

Annual Amount of Credit Calculation:

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Year 10

**Allowed amount should be equal to the lesser of Option 1 or Option 2**

Option 1 Calculation

Current Year Tax Liability

Less Base Year Average

Adjusted Liability

Multiply by 90%

$

0.90

$

0.90

$

0.90

$

0.90

$

0.90

$

0.90

$

0.90

$

0.90

$

0.90

$

0.90

Current Year Optional Investment Tax Credit

OR

Option 2 Calculation

Aggregate Credit Amount

Less: Sum of All Credits previously used

Unused Aggregate Credit Amount

Credit Allowed:

Optional Investment Tax Credit Available

Amount of Credit Allowed in current year

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1