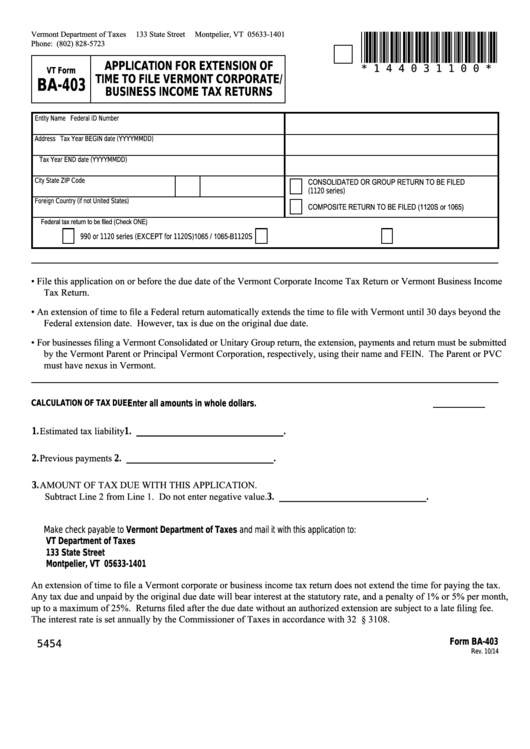

Vt Form Ba-403 - Application For Extension Of Time To File Vermont Corporate/ Business Income Tax Returns

ADVERTISEMENT

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

*144031100*

Phone: (802) 828-5723

APPLICATION FOR EXTENSION OF

VT Form

* 1 4 4 0 3 1 1 0 0 *

TIME TO FILE VERMONT CORPORATE/

BA-403

BUSINESS INCOME TAX RETURNS

Entity Name

Federal ID Number

Address

Tax Year BEGIN date (YYYYMMDD)

Tax Year END date (YYYYMMDD)

City

State

ZIP Code

CONSOLIDATED OR GROUP RETURN TO BE FILED

(1120 series)

Foreign Country (if not United States)

COMPOSITE RETURN TO BE FILED (1120S or 1065)

Federal tax return to be filed (Check ONE)

990 or 1120 series (EXCEPT for 1120S)

1120S

1065 / 1065-B

• File this application on or before the due date of the Vermont Corporate Income Tax Return or Vermont Business Income

Tax Return.

• An extension of time to file a Federal return automatically extends the time to file with Vermont until 30 days beyond the

Federal extension date. However, tax is due on the original due date.

• For businesses filing a Vermont Consolidated or Unitary Group return, the extension, payments and return must be submitted

by the Vermont Parent or Principal Vermont Corporation, respectively, using their name and FEIN. The Parent or PVC

must have nexus in Vermont.

CALCULATION OF TAX DUE

Enter all amounts in whole dollars.

1. Estimated tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. _______________________________ .

2. Previous payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. _______________________________ .

3. AMOUNT OF TAX DUE WITH THIS APPLICATION.

Subtract Line 2 from Line 1. Do not enter negative value. . . . . . . . . . . . . . . 3. _______________________________ .

Make check payable to Vermont Department of Taxes and mail it with this application to:

VT Department of Taxes

133 State Street

Montpelier, VT 05633-1401

An extension of time to file a Vermont corporate or business income tax return does not extend the time for paying the tax.

Any tax due and unpaid by the original due date will bear interest at the statutory rate, and a penalty of 1% or 5% per month,

up to a maximum of 25%. Returns filed after the due date without an authorized extension are subject to a late filing fee.

The interest rate is set annually by the Commissioner of Taxes in accordance with 32 V.S.A. § 3108.

Form BA-403

5454

Rev. 10/14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1