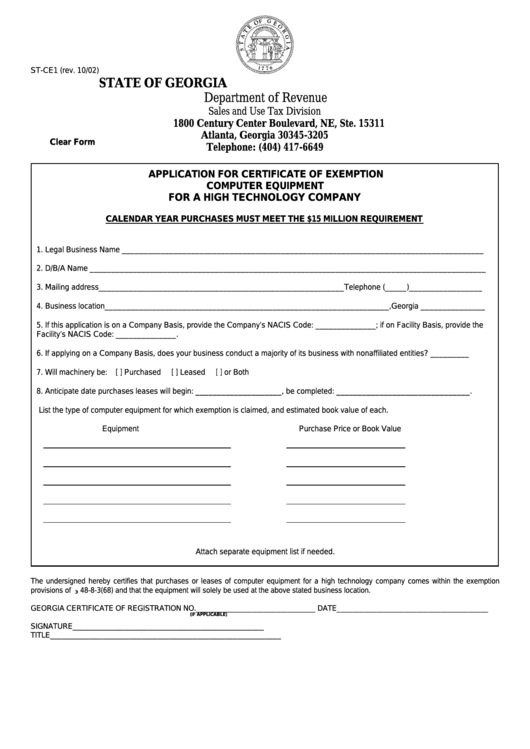

ST-CE1 (rev. 10/02)

STATE OF GEORGIA

Department of Revenue

Sales and Use Tax Division

1800 Century Center Boulevard, NE, Ste. 15311

Atlanta, Georgia 30345-3205

Clear Form

Telephone: (404) 417-6649

APPLICATION FOR CERTIFICATE OF EXEMPTION

COMPUTER EQUIPMENT

FOR A HIGH TECHNOLOGY COMPANY

CALENDAR YEAR PURCHASES MUST MEET THE $15 MILLION REQUIREMENT

1. Legal Business Name ____________________________________________________________________________________

2. D/B/A Name ____________________________________________________________________________________________

3. Mailing address_________________________________________________________Telephone (_____)_________________

4. Business location__________________________________________________________________,Georgia _______________

5. If this application is on a Company Basis, provide the Company’s NACIS Code: ______________; if on Facility Basis, provide the

Facility’s NACIS Code: ______________.

6. If applying on a Company Basis, does your business conduct a majority of its business with nonaffiliated entities? _________

7. Will machinery be:

[ ] Purchased

[ ] Leased

[ ] or Both

8. Anticipate date purchases leases will begin: ____________________, be completed: _______________________________.

List the type of computer equipment for which exemption is claimed, and estimated book value of each.

Equipment

Purchase Price or Book Value

Attach separate equipment list if needed.

The undersigned hereby certifies that purchases or leases of computer equipment for a high technology company comes within the exemption

provisions of O.C.G.A. ' 48-8-3(68) and that the equipment will solely be used at the above stated business location.

GEORGIA CERTIFICATE OF REGISTRATION NO.______________________________ DATE______________________________________

(IF APPLICABLE)

SIGNATURE________________________________________________

TITLE__________________________________________________________

1

1