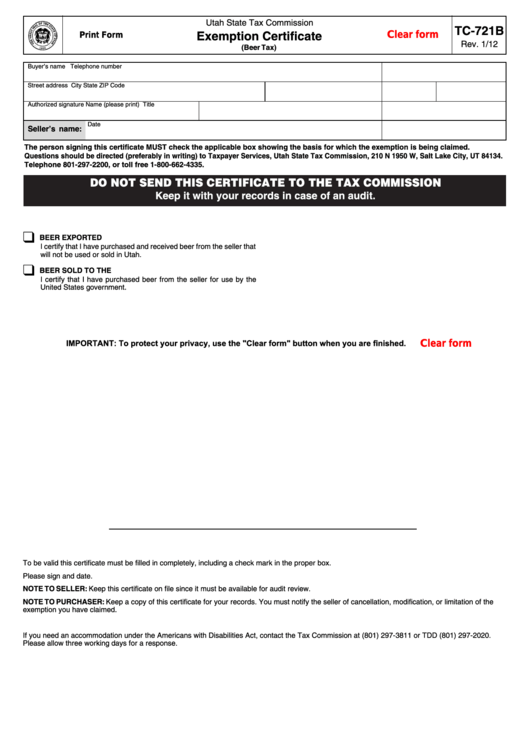

Utah State Tax Commission

TC-721B

Clear form

Exemption Certificate

Print Form

Rev. 1/12

(Beer Tax)

Buyer’s name

Telephone number

Street address

City

State

ZIP Code

Authorized signature

Name (please print)

Title

Date

Seller’s name:

The person signing this certificate MUST check the applicable box showing the basis for which the exemption is being claimed.

Questions should be directed (preferably in writing) to Taxpayer Services, Utah State Tax Commission, 210 N 1950 W, Salt Lake City, UT 84134.

Telephone 801-297-2200, or toll free 1-800-662-4335.

DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION

Keep it with your records in case of an audit.

❑

BEER EXPORTED

I certify that I have purchased and received beer from the seller that

will not be used or sold in Utah.

❑

BEER SOLD TO THE U.S. GOVERNMENT

I certify that I have purchased beer from the seller for use by the

United States government.

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

To be valid this certificate must be filled in completely, including a check mark in the proper box.

Please sign and date.

NOTE TO SELLER: Keep this certificate on file since it must be available for audit review.

NOTE TO PURCHASER: Keep a copy of this certificate for your records. You must notify the seller of cancellation, modification, or limitation of the

exemption you have claimed.

If you need an accommodation under the Americans with Disabilities Act, contact the Tax Commission at (801) 297-3811 or TDD (801) 297-2020.

Please allow three working days for a response.

DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION

1

1