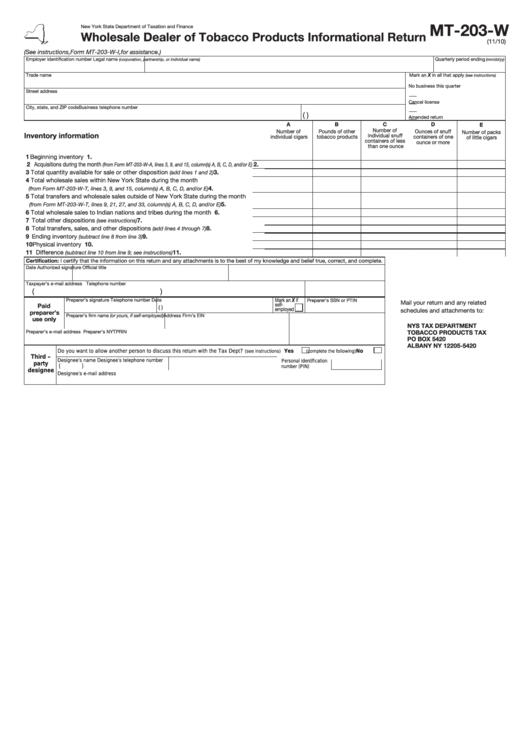

Form Mt-203-W - Wholesale Dealer Of Tobacco Products Informational Return

ADVERTISEMENT

MT-203-W

New York State Department of Taxation and Finance

Wholesale Dealer of Tobacco Products Informational Return

(11/10)

(See instructions, Form MT-203-W-I, for assistance.)

Employer identification number

Legal name

Quarterly period ending

(corporation, partnership, or individual name)

(mm/dd/yy)

Trade name

Mark an X in all that apply

(see instructions)

No business this quarter

Street address

Cancel license

City, state, and ZIP code

Business telephone number

(

)

Amended return

A

B

C

D

E

Number of

Number of

Pounds of other

Ounces of snuff

Number of packs

Inventory information

individual snuff

individual cigars

tobacco products

containers of one

of little cigars

containers of less

ounce or more

than one ounce

1 Beginning inventory .................................................................................................

1.

2 Acquisitions during the month

2.

(from Form MT-203-W-A, lines 3, 9, and 15, column(s) A, B, C, D, and/or E)

3 Total quantity available for sale or other disposition

3.

....................

(add lines 1 and 2)

4 Total wholesale sales within New York State during the month

....................

4.

(from Form MT-203-W-T, lines 3, 9, and 15, column(s) A, B, C, D, and/or E)

5 Total transfers and wholesale sales outside of New York State during the month

............

5.

(from Form MT-203-W-T, lines 9, 21, 27, and 33, column(s) A, B, C, D, and/or E)

6 Total wholesale sales to Indian nations and tribes during the month .....................

6.

7 Total other dispositions

..................................................................

7.

(see instructions)

8 Total transfers, sales, and other dispositions

.........................

8.

(add lines 4 through 7)

9 Ending inventory

...............................................................

9.

(subtract line 8 from line 3)

10 Physical inventory ................................................................................................... 10.

11 Difference

................................................ 11.

(subtract line 10 from line 9; see instructions)

Certification: I certify that the information on this return and any attachments is to the best of my knowledge and belief true, correct, and complete.

Date

Authorized signature

Official title

Taxpayer’s e-mail address

Telephone number

(

)

Mark an X if

Preparer’s signature

Telephone number

Date

Preparer’s SSN or PTIN

Mail your return and any related

self-

Paid

(

)

employed

schedules and attachments to:

preparer’s

Preparer’s firm name (or yours, if self-employed) Address

Firm’s EIN

use only

NYS TAX DEPARTMENT

Preparer’s e-mail address

Preparer’s NYTPRIN

TOBACCO PRODUCTS TAX

PO BOX 5420

ALBANY NY 12205-5420

Do you want to allow another person to discuss this return with the Tax Dept?

Yes

No

(see instructions)

(complete the following)

Third –

Designee’s name

Designee’s telephone number

Personal identification

party

(

)

number (PIN)

designee

Designee’s e-mail address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1