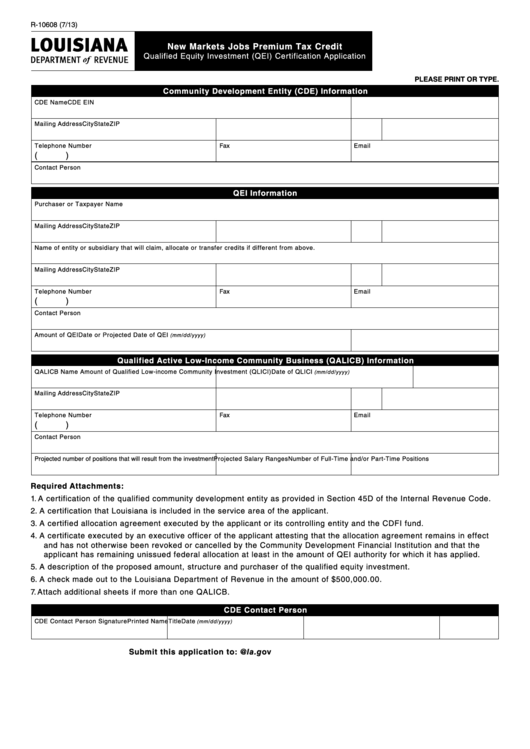

R-10608 (7/13)

New Markets Jobs Premium Tax Credit

Qualified Equity Investment (QEI) Certification Application

PLEASE PRINT OR TYPE.

Community Development Entity (CDE) Information

CDE Name

CDE EIN

Mailing Address

City

State

ZIP

Telephone Number

Fax

Email

(

)

Contact Person

QEI Information

Purchaser or Taxpayer Name

Mailing Address

City

State

ZIP

Name of entity or subsidiary that will claim, allocate or transfer credits if different from above.

Mailing Address

City

State

ZIP

Telephone Number

Fax

Email

(

)

Contact Person

Amount of QEI

Date or Projected Date of QEI

(mm/dd/yyyy)

Qualified Active Low-Income Community Business (QALICB) Information

QALICB Name

Amount of Qualified Low-income Community Investment (QLICI)

Date of QLICI

(mm/dd/yyyy)

Mailing Address

City

State

ZIP

Telephone Number

Fax

Email

(

)

Contact Person

Projected number of positions that will result from the investment

Projected Salary Ranges

Number of Full-Time and/or Part-Time Positions

Required Attachments:

1. A certification of the qualified community development entity as provided in Section 45D of the Internal Revenue Code.

2. A certification that Louisiana is included in the service area of the applicant.

3. A certified allocation agreement executed by the applicant or its controlling entity and the CDFI fund.

4. A certificate executed by an executive officer of the applicant attesting that the allocation agreement remains in effect

and has not otherwise been revoked or cancelled by the Community Development Financial Institution and that the

applicant has remaining unissued federal allocation at least in the amount of QEI authority for which it has applied.

5. A description of the proposed amount, structure and purchaser of the qualified equity investment.

6. A check made out to the Louisiana Department of Revenue in the amount of $500,000.00.

7. Attach additional sheets if more than one QALICB.

CDE Contact Person

CDE Contact Person Signature

Printed Name

Title

Date

(mm/dd/yyyy)

Submit this application to: NewMarketTax.CreditApplication@la.gov

1

1