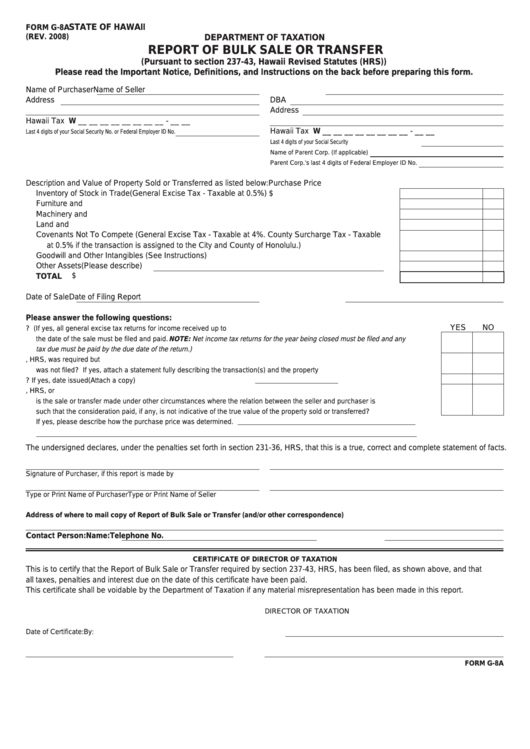

STATE OF HAWAII

FORM G-8A

(REV. 2008)

DEPARTMENT OF TAXATION

REPORT OF BULK SALE OR TRANSFER

(Pursuant to section 237-43, Hawaii Revised Statutes (HRS))

Please read the Important Notice, Definitions, and Instructions on the back before preparing this form.

Name of Purchaser

Name of Seller

Address

DBA

Address

Hawaii Tax I.D. No. W __ __ __ __ __ __ __ __ - __ __

Hawaii Tax I.D. No. W __ __ __ __ __ __ __ __ - __ __

Last 4 digits of your Social Security No. or Federal Employer ID No.

Last 4 digits of your Social Security No. or Federal Employer ID No.

Name of Parent Corp. (If applicable)

Parent Corp.’s last 4 digits of Federal Employer ID No.

Description and Value of Property Sold or Transferred as listed below:

Purchase Price

Inventory of Stock in Trade (General Excise Tax - Taxable at 0.5%)....................................................

$

Furniture and Fixtures ............................................................................................................................

Machinery and Equipment......................................................................................................................

Land and Buildings.................................................................................................................................

Covenants Not To Compete (General Excise Tax - Taxable at 4%. County Surcharge Tax - Taxable

at 0.5% if the transaction is assigned to the City and County of Honolulu.).......................................

Goodwill and Other Intangibles (See Instructions) .................................................................................

Other Assets (Please describe)

$

TOTAL

...............................................................................................................................................

Date of Sale

Date of Filing Report

Please answer the following questions:

YES

NO

1. Does this transaction terminate the business of the seller? (If yes, all general excise tax returns for income received up to

the date of the sale must be filed and paid. NOTE: Net income tax returns for the year being closed must be filed and any

tax due must be paid by the due date of the return.) ...................................................................................................................

2. Did the seller ever receive any property in a transaction for which a report under section 237-43, HRS, was required but

was not filed? If yes, attach a statement fully describing the transaction(s) and the property involved. ....................................

3. Was a tax clearance certificate issued to the seller? If yes, date issued

(Attach a copy) ..............

4. Are the seller and purchaser affiliated companies or persons within the meaning of section 231-3.1, HRS, or

is the sale or transfer made under other circumstances where the relation between the seller and purchaser is

such that the consideration paid, if any, is not indicative of the true value of the property sold or transferred? .........................

If yes, please describe how the purchase price was determined.

The undersigned declares, under the penalties set forth in section 231-36, HRS, that this is a true, correct and complete statement of facts.

Signature of Purchaser, if this report is made by Purchaser.

Signature of Seller

Type or Print Name of Purchaser

Type or Print Name of Seller

Address of where to mail copy of Report of Bulk Sale or Transfer (and/or other correspondence)

Contact Person: Name:

Telephone No.

CERTIFICATE OF DIRECTOR OF TAXATION

This is to certify that the Report of Bulk Sale or Transfer required by section 237-43, HRS, has been filed, as shown above, and that

all taxes, penalties and interest due on the date of this certificate have been paid.

This certificate shall be voidable by the Department of Taxation if any material misrepresentation has been made in this report.

DIRECTOR OF TAXATION

Date of Certificate:

By:

FORM G-8A

1

1 2

2