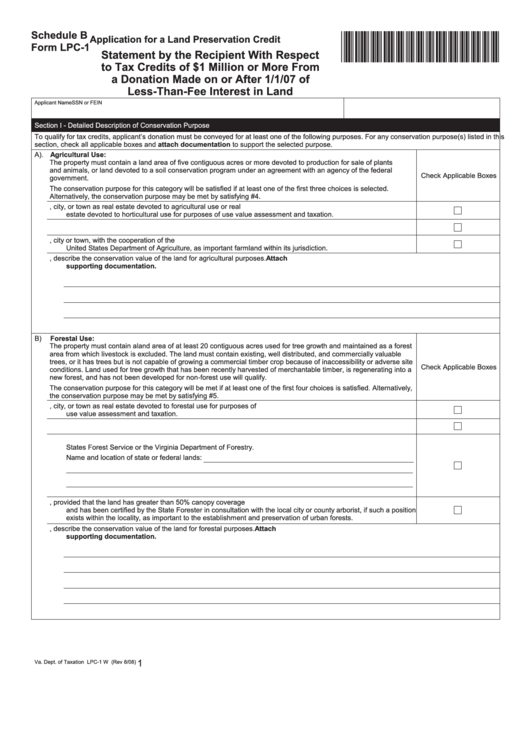

Schedule B

*VALPCB108888*

Application for a Land Preservation Credit

Form LPC-1

Statement by the Recipient With Respect

to Tax Credits of $1 Million or More From

a Donation Made on or After 1/1/07 of

Less-Than-Fee Interest in Land

Applicant Name

SSN or FEIN

Section I - Detailed Description of Conservation Purpose

To qualify for tax credits, applicant’s donation must be conveyed for at least one of the following purposes. For any conservation purpose(s) listed in this

section, check all applicable boxes and attach documentation to support the selected purpose.

A). Agricultural Use:

The property must contain a land area of five contiguous acres or more devoted to production for sale of plants

and animals, or land devoted to a soil conservation program under an agreement with an agency of the federal

Check Applicable Boxes

government.

The conservation purpose for this category will be satisfied if at least one of the first three choices is selected.

Alternatively, the conservation purpose may be met by satisfying #4.

1.

The property has been designated by a county, city, or town as real estate devoted to agricultural use or real

estate devoted to horticultural use for purposes of use value assessment and taxation.

2.

The property is part of an agricultural or agricultural and forestal district.

3.

The property has been designated by the governing body of any county, city or town, with the cooperation of the

United States Department of Agriculture, as important farmland within its jurisdiction.

4.

If the property does not meet any of the three conditions above, describe the conservation value of the land for agricultural purposes. Attach

supporting documentation.

Forestal Use:

B)

The property must contain a land area of at least 20 contiguous acres used for tree growth and maintained as a forest

area from which livestock is excluded. The land must contain existing, well distributed, and commercially valuable

trees, or it has trees but is not capable of growing a commercial timber crop because of inaccessibility or adverse site

Check Applicable Boxes

conditions. Land used for tree growth that has been recently harvested of merchantable timber, is regenerating into a

new forest, and has not been developed for non-forest use will qualify.

The conservation purpose for this category will be met if at least one of the first four choices is satisfied. Alternatively,

the conservation purpose may be met by satisfying #5.

1.

The property has been designated by a county, city, or town as real estate devoted to forestal use for purposes of

use value assessment and taxation.

2.

The property is part of a forestal or agricultural and forestal district.

3.

The property contains 20 acres or more of forest area that is adjacent to lands owned or managed by the United

States Forest Service or the Virginia Department of Forestry.

Name and location of state or federal lands:

4.

The property contains less than 20 acres of forest area, provided that the land has greater than 50% canopy coverage

and has been certified by the State Forester in consultation with the local city or county arborist, if such a position

exists within the locality, as important to the establishment and preservation of urban forests.

5.

If the property does not meet any of the three conditions above, describe the conservation value of the land for forestal purposes. Attach

supporting documentation.

1

Va. Dept. of Taxation LPC-1 W (Rev 8/08)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8