Instructions For Form G-26 - Use Tax Return

ADVERTISEMENT

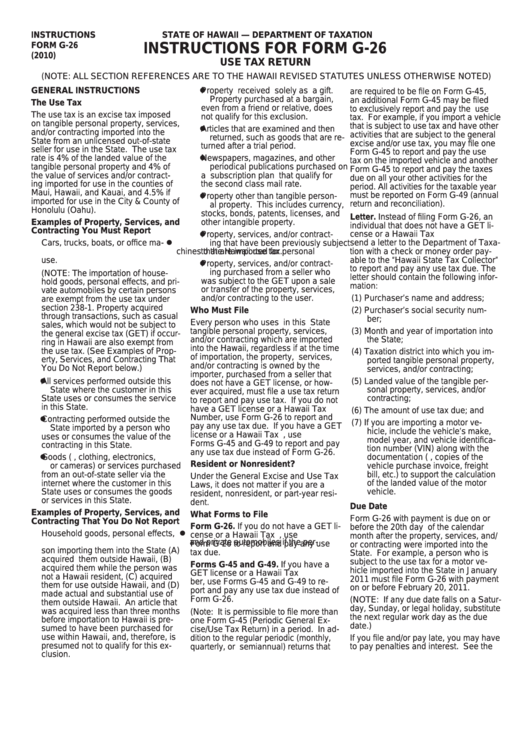

INSTRUCTIONS

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM G-26

INSTRUCTIONS FOR FORM G-26

(2010)

USE TAX RETURN

(NOTE: ALL SECTION REFERENCES ARE TO THE HAWAII REVISED STATUTES UNLESS OTHERWISE NOTED)

z

GENERAL INSTRUCTIONS

Property received solely as a gift.

are required to be file on Form G-45,

Property purchased at a bargain,

an additional Form G-45 may be filed

The Use Tax

even from a friend or relative, does

to exclusively report and pay the use

The use tax is an excise tax imposed

not qualify for this exclusion.

tax. For example, if you import a vehicle

on tangible personal property, services,

that is subject to use tax and have other

z

Articles that are examined and then

and/or contracting

imported into the

activities that are subject to the general

returned, such as goods that are re-

State from an unlicensed

out-of-state

excise and/or use tax, you may file one

turned after a trial period.

seller for use in the State.

The use tax

Form G-45 to report and pay the use

z

rate is 4% of the landed value of the

Newspapers, magazines, and other

tax on the imported vehicle and another

tangible personal property and 4% of

periodical publications purchased on

Form G-45 to report and pay the taxes

the value of services and/or contract-

a subscription plan that qualify for

due on all your other activities for the

ing imported for use in the counties of

the second class mail rate.

period. All activities for the taxable year

Maui, Hawaii, and Kauai, and 4.5% if

z

must be reported on Form G-49 (annual

Property other than tangible person-

imported for use in the City & County of

return and reconciliation).

al property. This includes currency,

Honolulu (Oahu).

stocks, bonds, patents, licenses, and

Letter. Instead of filing Form G-26, an

Examples of Property, Services, and

other intangible property.

individual that does not have a GET li-

Contracting You Must Report

z

Property, services, and/or contract-

cense or a Hawaii Tax I.D. Number may

z

Cars, trucks, boats, or office ma-

ing that have been previously subject

send a letter to the Department of Taxa-

chines that are imported for personal

to the Hawaii use tax.

tion with a check or money order pay-

use.

able to the “Hawaii State Tax Collector”

z

Property, services, and/or contract-

to report and pay any use tax due. The

ing purchased from a seller who

(NOTE: The importation of house-

letter should contain the following infor-

was subject to the GET upon a sale

hold goods, personal effects, and pri-

mation:

or transfer of the property, services,

vate automobiles by certain persons

and/or contracting to the user.

(1) Purchaser’s name and address;

are exempt from the use tax under

section 238-1. Property acquired

Who Must File

(2) Purchaser’s social security num-

through transactions, such as casual

ber;

Every person who uses in this State

sales, which would not be subject to

tangible personal property, services,

(3) Month and year of importation into

the general excise tax (GET) if occur-

and/or contracting which are imported

the State;

ring in Hawaii are also exempt from

into the Hawaii, regardless if at the time

the use tax. (See Examples of Prop-

(4) Taxation district into which you im-

of importation, the property, services,

erty, Services, and Contracting That

ported tangible personal property,

and/or contracting is owned by the

You Do Not Report below.)

services, and/or contracting;

importer, purchased from a seller that

z

All services performed outside this

(5) Landed value of the tangible per-

does not have a GET license, or how-

State where the customer in this

sonal property, services, and/or

ever acquired, must file a use tax return

State uses or consumes the service

contracting;

to report and pay use tax. If you do not

in this State.

have a GET license or a Hawaii Tax I.D.

(6) The amount of use tax due; and

z

Number, use Form G-26 to report and

Contracting performed outside the

(7) If you are importing a motor ve-

pay any use tax due. If you have a GET

State imported by a person who

hicle, include the vehicle’s make,

license or a Hawaii Tax I.D. Number, use

uses or consumes the value of the

model year, and vehicle identifica-

Forms G-45 and G-49 to report and pay

contracting in this State.

tion number (VIN) along with the

any use tax due instead of Form G-26.

z

Goods (e.g., clothing, electronics,

documentation (e.g., copies of the

Resident or Nonresident?

or cameras) or services purchased

vehicle purchase invoice, freight

from an out-of-state seller via the

bill, etc.) to support the calculation

Under the General Excise and Use Tax

internet where the customer in this

of the landed value of the motor

Laws, it does not matter if you are a

State uses or consumes the goods

vehicle.

resident, nonresident, or part-year resi-

or services in this State.

dent.

Due Date

Examples of Property, Services, and

What Forms to File

Form G-26 with payment is due on or

Contracting That You Do Not Report

Form G-26. If you do not have a GET li-

before the 20th day of the calendar

z

Household goods, personal effects,

cense or a Hawaii Tax I.D. Number, use

month after the property, services, and/

and private automobiles if the per-

Form G-26 to report and pay any use

or contracting were imported into the

son importing them into the State (A)

tax due.

State. For example, a person who is

acquired them outside Hawaii, (B)

subject to the use tax for a motor ve-

Forms G-45 and G-49. If you have a

acquired them while the person was

hicle imported into the State in January

GET license or a Hawaii Tax I.D. Num-

not a Hawaii resident, (C) acquired

2011 must file Form G-26 with payment

ber, use Forms G-45 and G-49 to re-

them for use outside Hawaii, and (D)

on or before February 20, 2011.

port and pay any use tax due instead of

made actual and substantial use of

Form G-26.

(NOTE: If any due date falls on a Satur-

them outside Hawaii. An article that

day, Sunday, or legal holiday, substitute

was acquired less than three months

(Note: It is permissible to file more than

the next regular work day as the due

before importation to Hawaii is pre-

one Form G-45 (Periodic General Ex-

date.)

sumed to have been purchased for

cise/Use Tax Return) in a period. In ad-

use within Hawaii, and, therefore, is

dition to the regular periodic (monthly,

If you file and/or pay late, you may have

presumed not to qualify for this ex-

quarterly, or semiannual) returns that

to pay penalties and interest. See the

clusion.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3