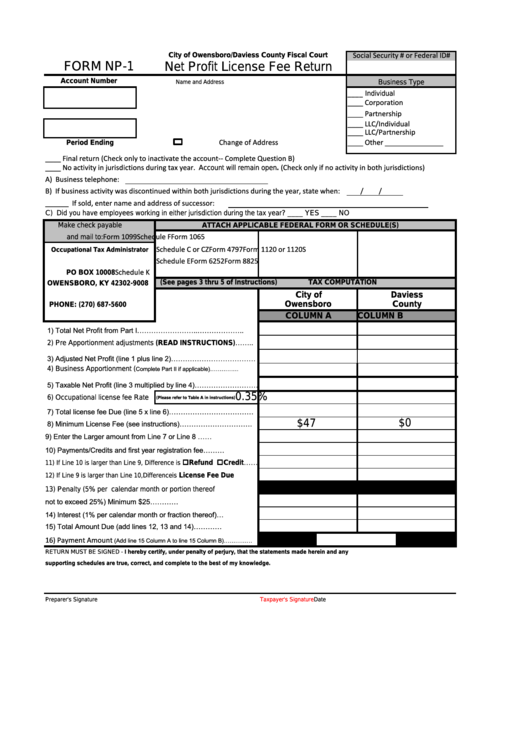

City of Owensboro/Daviess County Fiscal Court

Social Security # or Federal ID#

FORM NP-1

Net Profit License Fee Return

Account Number

Business Type

Name and Address

____ Individual

____ Corporation

____ Partnership

____ LLC/Individual

____ LLC/Partnership

Change of Address

____ Other _______________

Period Ending

____ Final return (Check only to inactivate the account-- Complete Question B)

____ No activity in jurisdictions during tax year.

(Check only if no activity in both jurisdictions)

Account will remain open.

A) Business telephone:

B) If business activity was discontinued within both jurisdictions during the year, state when:

/

/

______ If sold, enter name and address of successor:

C) Did you have employees working in either jurisdiction during the tax year? ____ YES ____ NO

Make check payable

ATTACH APPLICABLE FEDERAL FORM OR SCHEDULE(S)

Form 1099

Schedule F

Form 1065

and mail to:

Schedule C or CZ

Form 4797

Form 1120 or 1120S

Occupational Tax Administrator

Schedule E

Form 6252

Form 8825

Schedule K

PO BOX 10008

(See pages 3 thru 5 of Instructions)

TAX COMPUTATION

OWENSBORO, KY 42302-9008

City of

Daviess

Owensboro

County

PHONE: (270) 687-5600

COLUMN A

COLUMN B

1) Total Net Profit from Part I……………………..………………..

2) Pre Apportionment adjustments (READ INSTRUCTIONS)……..

3) Adjusted Net Profit (line 1 plus line 2)………………………………

Complete Part II if applicable)……………

4) Business Apportionment (

5) Taxable Net Profit (line 3 multiplied by line 4)………………………..

0.35%

6) Occupational license fee Rate

(Please refer to Table A in instructions)

7) Total license fee Due (line 5 x line 6)………………………………

$47

$0

8) Minimum License Fee (see instructions)………………………….

9) Enter the Larger amount from Line 7 or Line 8 ……....................... .

10) Payments/Credits and first year registration fee………...............

oRefund oCredit……

11) If Line 10 is larger than Line 9, Difference is

License Fee Due.............

12) If Line 9 is larger than Line 10, Difference is

13) Penalty (5% per calendar month or portion thereof

not to exceed 25%) Minimum $25…………...................

14) Interest (1% per calendar month or fraction thereof)…..............

15) Total Amount Due (add lines 12, 13 and 14)…………................

16) Payment Amount

(Add line 15 Column A to line 15 Column B)……………

RETURN MUST BE SIGNED - I hereby certify, under penalty of perjury, that the statements made herein and any

supporting schedules are true, correct, and complete to the best of my knowledge.

Preparer's Signature

Taxpayer's Signature

Date

1

1 2

2 3

3 4

4