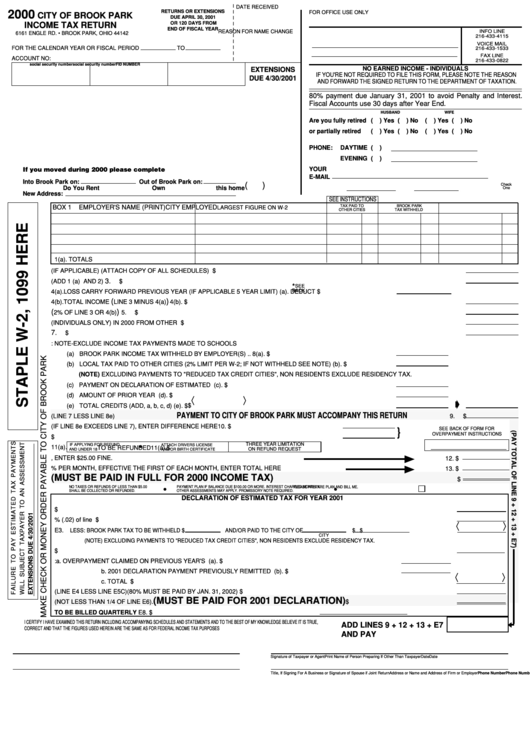

Form Income Tax Return - City Of Brook Park - 2000

ADVERTISEMENT

DATE RECEIVED

2000

RETURNS OR EXTENSIONS

FOR OFFICE USE ONLY

CITY OF BROOK PARK

DUE APRIL 30, 2001

OR 120 DAYS FROM

INCOME TAX RETURN

END OF FISCAL YEAR

REASON FOR NAME CHANGE

INFO LINE

6161 ENGLE RD. • BROOK PARK, OHIO 44142

216-433-4115

VOICE MAIL

FOR THE CALENDAR YEAR OR FISCAL PERIOD

TO

216-433-1533

FAX LINE

ACCOUNT NO:

216-433-0822

social security number

social security number

FID NUMBER

NO EARNED INCOME - INDIVIDUALS

EXTENSIONS

IF YOU'RE NOT REQUIRED TO FILE THIS FORM, PLEASE NOTE THE REASON

DUE 4/30/2001

AND FORWARD THE SIGNED RETURN TO THE DEPARTMENT OF TAXATION.

80% payment due January 31, 2001 to avoid Penalty and Interest.

Fiscal Accounts use 30 days after Year End.

HUSBAND

WIFE

Are you fully retired

(

) Yes (

) No

(

) Yes (

) No

or partially retired

(

) Yes (

) No

(

) Yes (

) No

PHONE:

DAYTIME

(

)

EVENING

(

)

YOUR

If you moved during 2000 please complete

E-MAIL

Into Brook Park on:

Out of Brook Park on:

(

)

Check

Do You Rent

Own

this home

One

New Address:

SEE INSTRUCTIONS

BOX 1

EMPLOYER'S NAME (PRINT)

CITY EMPLOYED

TAX PAID TO

BROOK PARK

LARGEST FIGURE ON W-2

OTHER CITIES

TAX WITHHELD

1(a). TOTALS

2.

TOTAL ADJUSTMENTS FROM PAGE 2 (IF APPLICABLE) (ATTACH COPY OF ALL SCHEDULES) ................................................................... 2.

$

3.

3.

TAXABLE INCOME (ADD 1 (a) AND 2) ..................................................................................................................................................................

$

*

SEE

BACK

4(a). LOSS CARRY FORWARD PREVIOUS YEAR (IF APPLICABLE 5 YEAR LIMIT) ..................................... 4(a). DEDUCT $

(

) ...............................................................................................................................

4(b). TOTAL INCOME

LINE 3 MINUS 4(a)

4(b). $

(

) ................................................................................................................

5.

BROOK PARK CITY TAX

2% OF LINE 3 OR 4(b)

5.

$

6.

REFUNDS RECEIVED (INDIVIDUALS ONLY) IN 2000 FROM OTHER MUNICIPALITIES ................................................................................... 6.

$

7.

7.

TOTAL INCOME TAX DUE BEFORE CREDITS .....................................................................................................................................................

$

8.

CREDITS: NOTE-EXCLUDE INCOME TAX PAYMENTS MADE TO SCHOOLS

(a) BROOK PARK INCOME TAX WITHHELD BY EMPLOYER(S) .............................................................................. 8(a). $

(b) LOCAL TAX PAID TO OTHER CITIES (2% LIMIT PER W-2; IF NOT WITHHELD SEE NOTE) ............................ 8(b). $

(NOTE) EXCLUDING PAYMENTS TO "REDUCED TAX CREDIT CITIES", NON RESIDENTS EXCLUDE RESIDENCY TAX.

(c) PAYMENT ON DECLARATION OF ESTIMATED TAX ........................................................................................... 8(c). $

(d) AMOUNT OF PRIOR YEAR CREDIT ..................................................................................................................... 8(d). $

〈

〉

➧

$

(e) TOTAL CREDITS (ADD, a, b, c, d) ......................................................................................................................... 8(e). $

PAYMENT TO CITY OF BROOK PARK MUST ACCOMPANY THIS RETURN

9.

BALANCE DUE (LINE 7 LESS LINE 8e)

.................................. 9.

$

10.

OVERPAYMENT CLAIMED (IF LINE 8e EXCEEDS LINE 7), ENTER DIFFERENCE HERE

10. $

SEE BACK OF FORM FOR

}

OVERPAYMENT INSTRUCTIONS

11.

ENTER AMOUNT OF LINE 10 YOU WANT CREDITED TO YOUR 2001 ESTIMATED TAX

11. $

•

THREE YEAR LIMITATION

IF APPLYING FOR REFUND

ATTACH DRIVERS LICENSE

11(a).

TO BE REFUNDED

11(a). $

AND UNDER 18

AND/OR BIRTH CERTIFICATE

ON REFUND REQUEST

12.

LATE FILING PENALTY - RETURNS FILED AFTER APRIL 30th, ENTER $25.00 FINE.

12. $

..................

13.

ASSESSMENT 3% PER MONTH, EFFECTIVE THE FIRST OF EACH MONTH, ENTER TOTAL HERE

13. $

..................

(MUST BE PAID IN FULL FOR 2000 INCOME TAX)

14.

TOTAL AMOUNT DUE -

...........................14.

$

•

•

NO TAXES OR REFUNDS OF LESS THAN $5.00

PAYMENT PLAN IF BALANCE DUE $100.00 OR MORE. INTEREST CHARGED MONTHLY.

PLEASE PREPARE PLAN AND BILL ME.

SHALL BE COLLECTED OR REFUNDED.

OTHER ASSESSMENTS MAY APPLY. PROMISSORY NOTE REQUIRED.

DECLARATION OF ESTIMATED TAX FOR YEAR 2001

E1.

ESTIMATED TAXABLE INCOME FOR YEAR .................................................................................................................................................. E1. $

E2.

ESTIMATED TAX DUE 2% (.02) of line E1 ....................................................................................................................................................... E2. $

〈

〉

E3.

LESS: BROOK PARK TAX TO BE WITHHELD $

AND/OR PAID TO THE CITY OF

$ ......................................................... E3. $

CITY

(NOTE) EXCLUDING PAYMENTS TO "REDUCED TAX CREDIT CITIES", NON RESIDENTS EXCLUDE RESIDENCY TAX.

E4.

TOTAL ESTIMATED BROOK PARK TAX DUE ................................................................................................................................................ E4. $

E5.

CREDITS: a. OVERPAYMENT CLAIMED ON PREVIOUS YEAR'S RETURN .......................................................... E5(a). $

b. 2001 DECLARATION PAYMENT PREVIOUSLY REMITTED ............................................................... E5(b). $

〈

〉

c. TOTAL CREDITS ........................................................................................................................................................................ E5. $

.........

E6.

NET TAX DUE (LINE E4 LESS LINE E5C)

(80% MUST BE PAID BY JAN. 31, 2002) ......................................................................... E6. $

(MUST BE PAID FOR 2001 DECLARATION)

E7.

AMOUNT PAID (NOT LESS THAN 1/4 OF LINE E6).

.....................E7. $

............................

E8.

BALANCE OF ESTIMATED TAXES TO BE BILLED QUARTERLY

E8. $

I CERTIFY I HAVE EXAMINED THIS RETURN INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS AND TO THE BEST OF MY KNOWLEDGE BELIEVE IT IS TRUE,

ADD LINES 9 + 12 + 13 + E7

CORRECT AND THAT THE FIGURES USED HEREIN ARE THE SAME AS FOR FEDERAL INCOME TAX PURPOSES

AND PAY

Print Name of Person Preparing If Other Than Taxpayer

Date

Signature of Taxpayer or Agent

Date

Address or Name and Address of Firm or Employer

Phone Number

Title, If Signing For A Business or Signature of Spouse if Joint Return

Phone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2