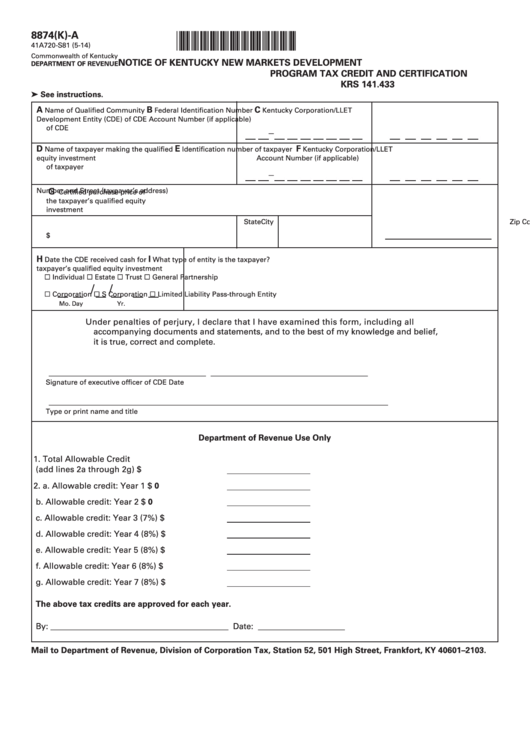

Form 8874(K)-A - Notice Of Kentucky New Markets Development Program Tax Credit And Certification

ADVERTISEMENT

8874(K)-A

*1400010320*

41A720-S81 (5-14)

Commonwealth of Kentucky

NOTICE OF KENTUCKY NEW MARKETS DEVELOPMENT

DEPARTMENT OF REVENUE

PROGRAM TAX CREDIT AND CERTIFICATION

KRS 141.433

➤ See instructions.

A

B

C

Name of Qualified Community

Federal Identification Number

Kentucky Corporation/LLET

Development Entity (CDE)

of CDE

Account Number (if applicable)

of CDE

–

D

E

F

Name of taxpayer making the qualified

Identification number of taxpayer

Kentucky Corporation/LLET

equity investment

Account Number (if applicable)

of taxpayer

–

Number and Street (taxpayer’s address)

G

Certified purchase price of

the taxpayer’s qualified equity

investment

City

State

Zip Code

$

H

I

Date the CDE received cash for

What type of entity is the taxpayer?

taxpayer’s qualified equity investment

¨ Individual

¨ Estate

¨ Trust

¨ General Partnership

/

/

¨ Corporation

¨ S Corporation

¨ Limited Liability Pass-through Entity

Mo.

Day

Yr.

Under penalties of perjury, I declare that I have examined this form, including all

accompanying documents and statements, and to the best of my knowledge and belief,

it is true, correct and complete.

______________________________________

______________________________________

Signature of executive officer of CDE

Date

__________________________________________________________________________________

Type or print name and title

Department of Revenue Use Only

1. Total Allowable Credit

(add lines 2a through 2g)

$

2. a. Allowable credit: Year 1

$

0

b. Allowable credit: Year 2

$

0

c. Allowable credit: Year 3 (7%)

$

d. Allowable credit: Year 4 (8%)

$

e. Allowable credit: Year 5 (8%)

$

f. Allowable credit: Year 6 (8%)

$

g. Allowable credit: Year 7 (8%)

$

The above tax credits are approved for each year.

By: ___________________________________________

Date: _____________________

Mail to Department of Revenue, Division of Corporation Tax, Station 52, 501 High Street, Frankfort, KY 40601–2103.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2