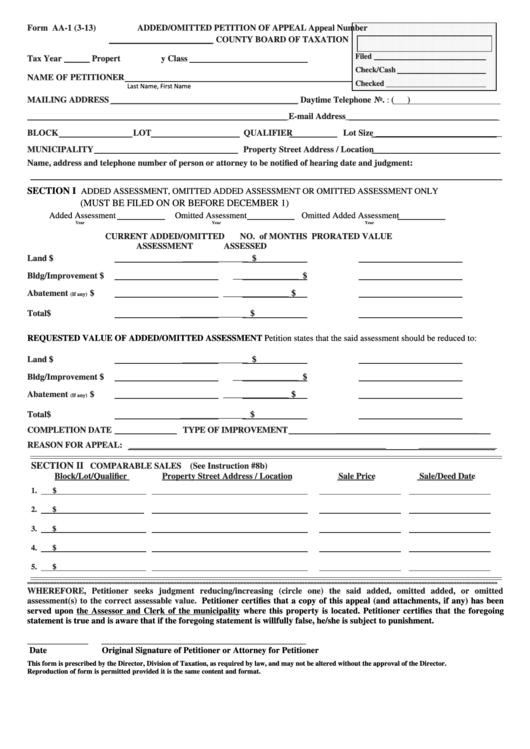

Form AA-1 (3-13)

ADDED/OMITTED PETITION OF APPEAL

Appeal Number

________________________ COUNTY BOARD OF TAXATION

Filed

Tax Year ______

Property Class

Check/Cash

NAME OF PETITIONER

Checked

Last Name, First Name

MAILING ADDRESS ___________________________________________ Daytime Telephone No. : (

)

____________________________________________________________ E-mail Address ___________________________________

BLOCK

LOT

QUALIFIER

Lot Size _____________________________

MUNICIPALITY

Property Street Address / Location

Name, address and telephone number of person or attorney to be notified of hearing date and judgment:

SECTION I

ADDED ASSESSMENT, OMITTED ADDED ASSESSMENT OR OMITTED ASSESSMENT ONLY

(MUST BE FILED ON OR BEFORE DECEMBER 1)

Added Assessment

Omitted Assessment

Omitted Added Assessment

Year

Year

Year

CURRENT ADDED/OMITTED

NO. of MONTHS

PRORATED VALUE

ASSESSMENT

ASSESSED

Land

$

_______________

$

Bldg/Improvement

$

_______________

$

Abatement

$

_______________

$

(If any)

Total

$

_______________

$

REQUESTED VALUE OF ADDED/OMITTED ASSESSMENT Petition states that the said assessment should be reduced to:

Land

$

_______________

$

Bldg/Improvement

$

_______________

$

Abatement

$

_______________

$

(If any)

Total

$

$

_______________

COMPLETION DATE

TYPE OF IMPROVEMENT

_________________________________

REASON FOR APPEAL: ___________________________________________________________

__________________

SECTION II

COMPARABLE SALES (See Instruction #8b)

Block/Lot/Qualifier

Property Street Address / Location

Sale Price

Sale/Deed Date

1.

$

2.

$

3.

$

4.

$

5.

$

=================================================================================================================================================================

WHEREFORE, Petitioner seeks judgment reducing/increasing (circle one) the said added, omitted added, or omitted

assessment(s) to the correct assessable value.

Petitioner certifies that a copy of this appeal (and attachments, if any) has been

served upon the Assessor and Clerk of the municipality where this property is located. Petitioner certifies that the foregoing

statement is true and is aware that if the foregoing statement is willfully false, he/she is subject to punishment.

______________

_______________________________________________

Date

Original Signature of Petitioner or Attorney for Petitioner

This form is prescribed by the Director, Division of Taxation, as required by law, and may not be altered without the approval of the Director.

Reproduction of form is permitted provided it is the same content and format.

1

1 2

2 3

3