Reset Form

Print Form

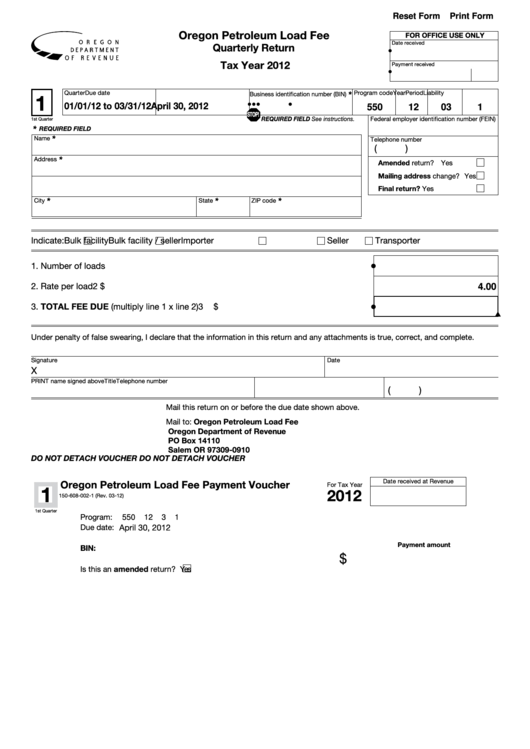

Oregon Petroleum Load Fee

FOR OFFICE USE ONLY

Date received

Quarterly Return

•

Tax Year 2012

Payment received

•

Quarter

Due date

*

Program code Year

Period

Liability

1

Business identification number (BIN)

•

•

•

•

01/01/12 to 03/31/12 April 30, 2012

550

12

03

1

STOP!

RequiRed Field See instructions.

Federal employer identification number (FEIN)

1st Quarter

*

RequiRed Field

*

Name

Telephone number

(

)

*

Address

Amended return?

Yes

Mailing address change? Yes

Final return?

Yes

*

*

*

City

State

ZIP code

Indicate:

Bulk facility

Bulk facility / seller

Importer

Seller

Transporter

•

1. Number of loads .........................................................................................................1

2. Rate per load ..............................................................................................................2

$

4.00

•

3. TOTAL FEE DUE (multiply line 1 x line 2) ...................................................................3

$

Under penalty of false swearing, I declare that the information in this return and any attachments is true, correct, and complete.

Signature

Date

X

PRINT name signed above

Title

Telephone number

(

)

Mail this return on or before the due date shown above.

Mail to: Oregon Petroleum Load Fee

Oregon Department of Revenue

PO Box 14110

Salem OR 97309-0910

do not detach voucher

do not detach voucher

Date received at Revenue

Oregon Petroleum Load Fee Payment Voucher

For Tax Year

1

2012

150-608-002-1 (Rev. 03-12)

1st Quarter

Program:

550

12

3

1

Due date:

April 30, 2012

Payment amount

BIN:

$

Is this an amended return?

Yes

OCR FONT FOR SCANLINE USE—NEED FOR CALC FORM—DON’T DELETE

1

1 2

2