A

D

R

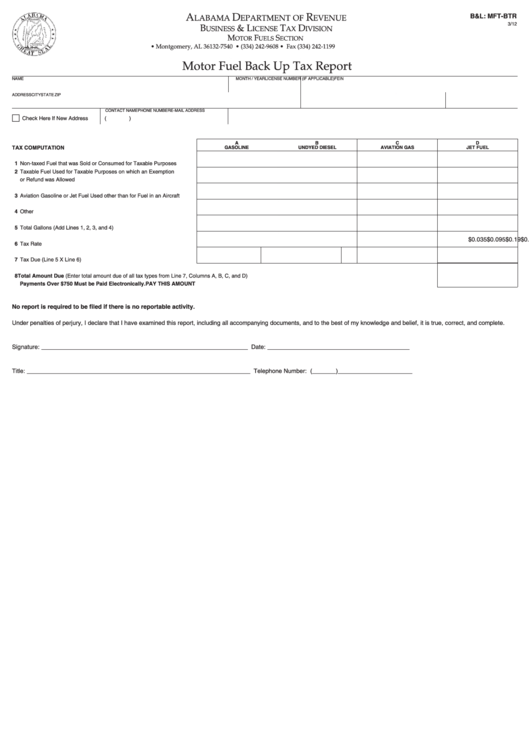

B&L: MFT-BTR

LABAMA

EPARTMENT OF

EVENUE

3/12

B

& L

T

D

RESET

USINESS

ICENSE

AX

IVISION

M

F

S

OTOR

UELS

ECTION

P.O. Box 327540 • Montgomery, AL 36132-7540 • (334) 242-9608 • Fax (334) 242-1199

Motor Fuel Back Up Tax Report

NAME

MONTH / YEAR

LICENSE NUMBER (IF APPLICABLE)

FEIN

ADDRESS

CITY

STATE

ZIP

CONTACT NAME

PHONE NUMBER

E-MAIL ADDRESS

Check Here If New Address

(

)

A

B

C

D

TAX COMPUTATION

GASOLINE

UNDYED DIESEL

AVIATION GAS

JET FUEL

1 Non-taxed Fuel that was Sold or Consumed for Taxable Purposes . . . . . .

2 Taxable Fuel Used for Taxable Purposes on which an Exemption

or Refund was Allowed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Aviation Gasoline or Jet Fuel Used other than for Fuel in an Aircraft . . . . .

4 Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Total Gallons (Add Lines 1, 2, 3, and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$0.16

$0.19

$0.095

$0.035

6 Tax Rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Tax Due (Line 5 X Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Total Amount Due (Enter total amount due of all tax types from Line 7, Columns A, B, C, and D)

Payments Over $750 Must be Paid Electronically. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . PAY THIS AMOUNT

No report is required to be filed if there is no reportable activity.

Under penalties of perjury, I declare that I have examined this report, including all accompanying documents, and to the best of my knowledge and belief, it is true, correct, and complete.

Signature: _____________________________________________________________ Date: __________________________________________

Title: __________________________________________________________________ Telephone Number: (_______)______________________

1

1 2

2