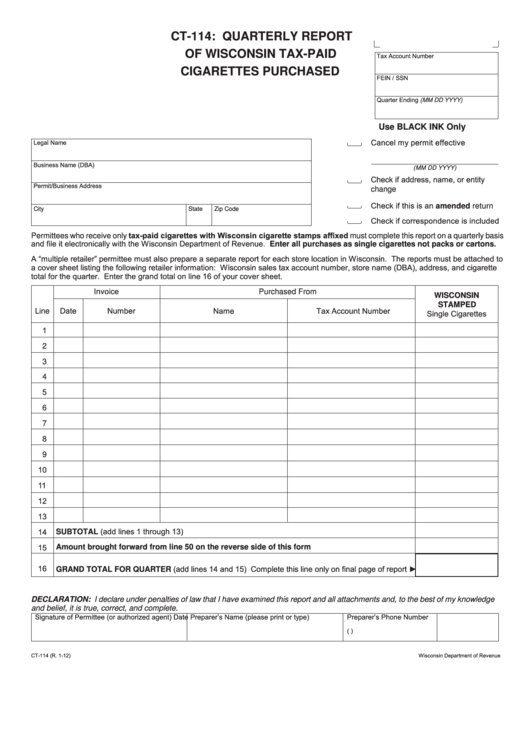

CT-114: QUARTERLY REPORT

OF WISCONSIN TAX-PAID

Tax Account Number

CIGARETTES PURCHASED

FEIN / SSN

Quarter Ending (MM DD YYYY)

Use BLACK INK Only

Cancel my permit effective

Legal Name

Business Name (DBA)

(MM DD YYYY)

Check if address, name, or entity

Permit/Business Address

change

Check if this is an amended return

State

City

Zip Code

Check if correspondence is included

Permittees who receive only tax-paid cigarettes with Wisconsin cigarette stamps affixed must complete this report on a quarterly basis

and file it electronically with the Wisconsin Department of Revenue. Enter all purchases as single cigarettes not packs or cartons.

A “multiple retailer” permittee must also prepare a separate report for each store location in Wisconsin. The reports must be attached to

a cover sheet listing the following retailer information: Wisconsin sales tax account number, store name (DBA), address, and cigarette

total for the quarter. Enter the grand total on line 16 of your cover sheet.

Invoice

Purchased From

WISCONSIN

STAMPED

Date

Number

Name

Tax Account Number

Line

Single Cigarettes

1

2

3

4

5

6

7

8

9

10

11

12

13

SUBTOTAL (add lines 1 through 13)

14

15

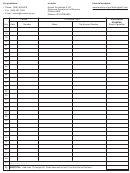

Amount brought forward from line 50 on the reverse side of this form

16

GRAND TOTAL FOR QUARTER (add lines 14 and 15) Complete this line only on final page of report ►

DECLARATION: I declare under penalties of law that I have examined this report and all attachments and, to the best of my knowledge

and belief, it is true, correct, and complete.

Signature of Permittee (or authorized agent)

Preparer’s Name (please print or type)

Preparer’s Phone Number

Date

(

)

CT-114 (R. 1-12)

Wisconsin Department of Revenue

1

1 2

2