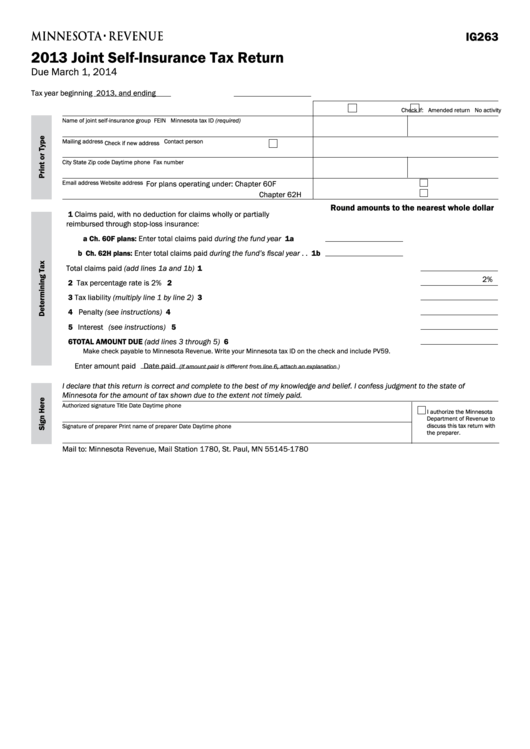

IG263

2013 Joint Self-Insurance Tax Return

Due March 1, 2014

Tax year beginning

2013, and ending

Check if:

Amended return

No activity

Name of joint self-insurance group

FEIN

Minnesota tax ID (required)

Mailing address

Contact person

Check if new address

City

State

Zip code

Daytime phone

Fax number

Email address

Website address

For plans operating under:

Chapter 60F

Chapter 62H

Round amounts to the nearest whole dollar

1 Claims paid, with no deduction for claims wholly or partially

reimbursed through stop-loss insurance:

a Ch. 60F plans: Enter total claims paid during the fund year . . . . . . . 1a

b Ch. 62H plans: Enter total claims paid during the fund’s fiscal year . . 1b

Total claims paid (add lines 1a and 1b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2%

2 Tax percentage rate is 2% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Tax liability (multiply line 1 by line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 TOTAL AMOUNT DUE (add lines 3 through 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Make check payable to Minnesota Revenue . Write your Minnesota tax ID on the check and include PV59 .

Enter amount paid

Date paid

(If amount paid is different from line 6, attach an explanation.)

I declare that this return is correct and complete to the best of my knowledge and belief. I confess judgment to the state of

Minnesota for the amount of tax shown due to the extent not timely paid.

Authorized signature

Title

Date

Daytime phone

I authorize the Minnesota

Department of Revenue to

discuss this tax return with

Signature of preparer

Print name of preparer

Date

Daytime phone

the preparer .

Mail to: Minnesota Revenue, Mail Station 1780, St . Paul, MN 55145-1780

1

1 2

2