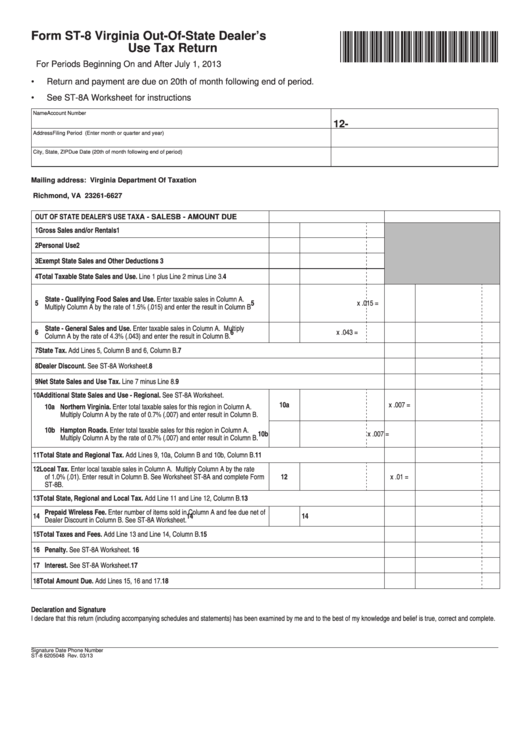

Form ST-8

Virginia Out-Of-State Dealer’s

*VAST08113888*

Use Tax Return

For Periods Beginning On and After July 1, 2013

•

Return and payment are due on 20th of month following end of period.

•

See ST-8A Worksheet for instructions

Name

Account Number

12-

Address

Filing Period (Enter month or quarter and year)

City, State, ZIP

Due Date (20th of month following end of period)

Mailing address: Virginia Department Of Taxation

P.O. Box 26627

Richmond, VA 23261-6627

OUT OF STATE DEALER’S USE TAX

A - SALES

B - AMOUNT DUE

1 Gross Sales and/or Rentals

1

2 Personal Use

2

3 Exempt State Sales and Other Deductions

3

4 Total Taxable State Sales and Use. Line 1 plus Line 2 minus Line 3.

4

State - Qualifying Food Sales and Use. Enter taxable sales in Column A.

5

5

x .015 =

Multiply Column A by the rate of 1.5% (.015) and enter the result in Column B

State - General Sales and Use. Enter taxable sales in Column A. Multiply

6

6

x .043 =

Column A by the rate of 4.3% (.043) and enter the result in Column B.

7 State Tax. Add Lines 5, Column B and 6, Column B.

7

8 Dealer Discount. See ST-8A Worksheet.

8

9 Net State Sales and Use Tax. Line 7 minus Line 8.

9

10 Additional State Sales and Use - Regional. See ST-8A Worksheet.

10a

x .007 =

10a Northern Virginia. Enter total taxable sales for this region in Column A.

Multiply Column A by the rate of 0.7% (.007) and enter result in Column B.

10b Hampton Roads. Enter total taxable sales for this region in Column A.

10b

x .007 =

Multiply Column A by the rate of 0.7% (.007) and enter result in Column B.

11 Total State and Regional Tax. Add Lines 9, 10a, Column B and 10b, Column B.

11

12 Local Tax. Enter local taxable sales in Column A. Multiply Column A by the rate

of 1.0% (.01). Enter result in Column B. See Worksheet ST-8A and complete Form

12

x .01 =

ST-8B.

13 Total State, Regional and Local Tax. Add Line 11 and Line 12, Column B.

13

Prepaid Wireless Fee. Enter number of items sold in Column A and fee due net of

14

14

14

Dealer Discount in Column B. See ST-8A Worksheet.

15 Total Taxes and Fees. Add Line 13 and Line 14, Column B.

15

16 Penalty. See ST-8A Worksheet.

16

17 Interest. See ST-8A Worksheet.

17

18 Total Amount Due. Add Lines 15, 16 and 17.

18

Declaration and Signature

I declare that this return (including accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is true, correct and complete.

Signature

Date

Phone Number

ST-8 6205048 Rev. 03/13

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10