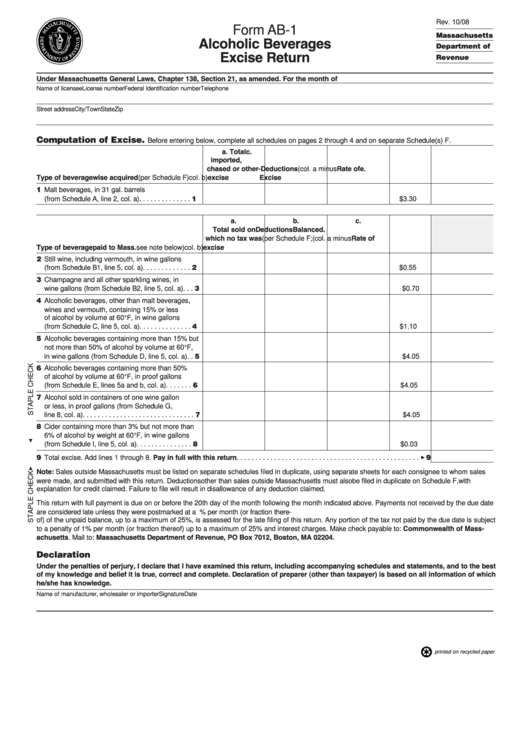

Rev. 10/08

Form AB-1

Massachusetts

Alcoholic Beverages

Department of

Excise Return

Revenue

Under Massachusetts General Laws, Chapter 138, Section 21, as amended. For the month of

Name of licensee

License number

Federal Identification number

Telephone

Street address

City/Town

State

Zip

Computation of Excise.

Before entering below, complete all schedules on pages 2 through 4 and on separate Schedule(s) F.

a. Total

c.

imported, pur-

b.

Balance

d.

chased or other-

Deductions

(col. a minus

Rate of

e.

Type of beverage

wise acquired

(per Schedule F)

col. b)

excise

Excise

1 Malt beverages, in 31 gal. barrels

(from Schedule A, line 2, col. a) . . . . . . . . . . . . . . 1

$3.30

a.

b.

c.

Total sold on

Deductions

Balance

d.

which no tax was

(per Schedule F;

(col. a minus

Rate of

Type of beverage

paid to Mass.

see note below)

col. b)

excise

2 Still wine, including vermouth, in wine gallons

(from Schedule B1, line 5, col. a) . . . . . . . . . . . . . 2

$0.55

3 Champagne and all other sparkling wines, in

wine gallons (from Schedule B2, line 5, col. a) . . . 3

$0.70

4 Alcoholic beverages, other than malt beverages,

wines and vermouth, containing 15% or less

of alcohol by volume at 60°F, in wine gallons

(from Schedule C, line 5, col. a) . . . . . . . . . . . . . . 4

$1.10

5 Alcoholic beverages containing more than 15% but

not more than 50% of alcohol by volume at 60°F,

in wine gallons (from Schedule D, line 5, col. a) . . 5

$4.05

6 Alcoholic beverages containing more than 50%

of alcohol by volume at 60°F, in proof gallons

(from Schedule E, lines 5a and b, col. a) . . . . . . . 6

$4.05

7 Alcohol sold in containers of one wine gallon

or less, in proof gallons (from Schedule G,

line 8, col. a). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

$4.05

8 Cider containing more than 3% but not more than

6% of alcohol by weight at 60°F, in wine gallons

(from Schedule I, line 5, col. a) . . . . . . . . . . . . . . . 8

$0.03

9 Total excise. Add lines 1 through 8. Pay in full with this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 9

Note: Sales outside Massachusetts must be listed on separate schedules filed in duplicate, using separate sheets for each consignee to whom sales

were made, and submitted with this return. Deductions other than sales outside Massachusetts must also be filed in duplicate on Schedule F, with

explanation for credit claimed. Failure to file will result in disallowance of any deduction claimed.

This return with full payment is due on or before the 20th day of the month following the month indicated above. Payments not received by the due date

are considered late unless they were postmarked at a U.S. post office at least two days prior to the due date. A penalty of 1% per month (or fraction there-

of) of the unpaid balance, up to a maximum of 25%, is assessed for the late filing of this return. Any portion of the tax not paid by the due date is subject

to a penalty of 1% per month (or fraction thereof) up to a maximum of 25% and interest charges. Make check payable to: Commonwealth of Mass-

achusetts. Mail to: Massachusetts Department of Revenue, PO Box 7012, Boston, MA 02204.

Declaration

Under the penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best

of my knowledge and belief it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which

he/she has knowledge.

Name of manufacturer, wholesaler or importer

Signature

Date

printed on recycled paper

1

1 2

2 3

3 4

4