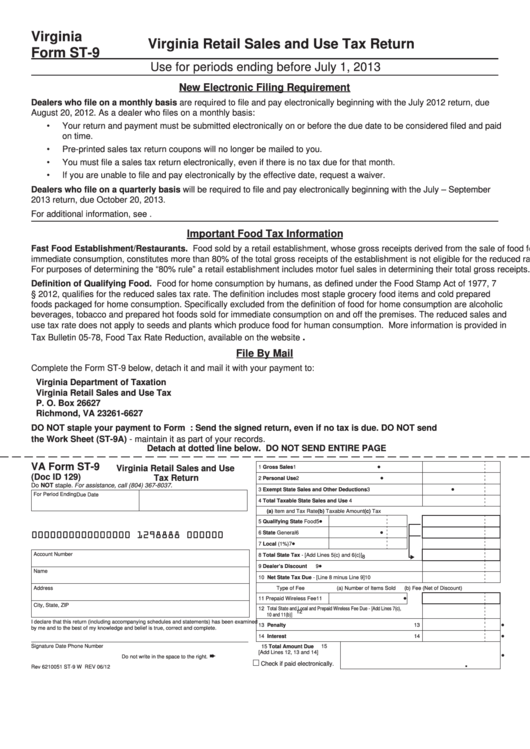

Virginia

Virginia Retail Sales and Use Tax Return

Form ST-9

Use for periods ending before July 1, 2013

New Electronic Filing Requirement

Dealers who file on a monthly basis are required to file and pay electronically beginning with the July 2012 return, due

August 20, 2012. As a dealer who files on a monthly basis:

•

Your return and payment must be submitted electronically on or before the due date to be considered filed and paid

on time.

•

Pre-printed sales tax return coupons will no longer be mailed to you.

•

You must file a sales tax return electronically, even if there is no tax due for that month.

•

If you are unable to file and pay electronically by the effective date, request a waiver.

Dealers who file on a quarterly basis will be required to file and pay electronically beginning with the July – September

2013 return, due October 20, 2013.

For additional information, see

Important Food Tax Information

Fast Food Establishment/Restaurants. Food sold by a retail establishment, whose gross receipts derived from the sale of food for

immediate consumption, constitutes more than 80% of the total gross receipts of the establishment is not eligible for the reduced rate.

For purposes of determining the “80% rule” a retail establishment includes motor fuel sales in determining their total gross receipts.

Definition of Qualifying Food. Food for home consumption by humans, as defined under the Food Stamp Act of 1977, 7

U.S.C. § 2012, qualifies for the reduced sales tax rate. The definition includes most staple grocery food items and cold prepared

foods packaged for home consumption. Specifically excluded from the definition of food for home consumption are alcoholic

beverages, tobacco and prepared hot foods sold for immediate consumption on and off the premises. The reduced sales and

use tax rate does not apply to seeds and plants which produce food for human consumption. More information is provided in

.

Tax Bulletin 05-78, Food Tax Rate Reduction, available on the website

File By Mail

Complete the Form ST-9 below, detach it and mail it with your payment to:

Virginia Department of Taxation

Virginia Retail Sales and Use Tax

P. O. Box 26627

Richmond, VA 23261-6627

DO NOT staple your payment to Form ST-9. Required: Send the signed return, even if no tax is due. DO NOT send

the Work Sheet (ST-9A) - maintain it as part of your records.

Detach at dotted line below. DO NOT SEND ENTIRE PAGE

VA Form ST-9

•

Virginia Retail Sales and Use

1 Gross Sales

1

(Doc ID 129)

•

Tax Return

2 Personal Use

2

Do NOT staple.

For assistance, call (804) 367-8037.

•

3 Exempt State Sales and Other Deductions

3

For Period Ending

Due Date

4 Total Taxable State Sales and Use

4

(b) Taxable Amount

(c) Tax

(a) Item and Tax Rate

•

5 Qualifying State Food

5

•

0000000000000000 1298888 000000

6 State General

6

•

7 Local (1%)

7

Account Number

8 Total State Tax - [Add Lines 5(c) and 6(c)]

8

•

9 Dealer’s Discount

9

Name

10 Net State Tax Due - [Line 8 minus Line 9]

10

Address

Type of Fee

(a) Number of Items Sold

(b) Fee (Net of Discount)

•

11 Prepaid Wireless Fee

11

City, State, ZIP

12 Total State and Local and Prepaid Wireless Fee Due - [Add Lines 7(c),

12

10 and 11(b)]

I declare that this return (including accompanying schedules and statements) has been examined

•

13 Penalty

13

by me and to the best of my knowledge and belief is true, correct and complete.

•

14 Interest

14

Signature

Date

Phone Number

15 Total Amount Due

15

[Add Lines 12, 13 and 14]

•

➨

Do not write in the space to the right.

.

Check if paid electronically.

Rev 6210051 ST-9 W REV 06/12

1

1 2

2 3

3